- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

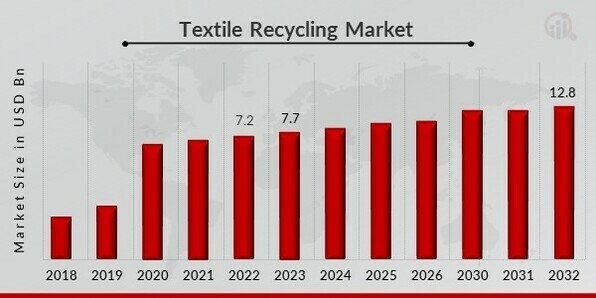

Global Textile Recycling Market Overview

Textile Recycling Market Size was valued at USD 7.2 Billion in 2022. The Textile Recycling industry is projected to grow from USD 7.7 Billion in 2023 to USD 12.8 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.60% during the forecast period (2023 - 2032). The expanding public knowledge of textile recycling and the growing environmental concern about the generation of textile waste, are the key market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Textile Recycling Market Trends

-

The rising environmental concern about textile waste production is driving the market growth

Growing social awareness of textile recycling and growing environmental concerns about the manufacturing of textile waste are anticipated to drive market expansion. The Environmental Protection Agency (EPA) estimates that textile waste takes about 5% of landfill area. The average amount of textiles produced annually in the United States is 25 billion pounds or 82 pounds per person. Over the projection period, the aforementioned factors are anticipated to fuel demand for textile recycling. Recycling textile waste promotes environmental sustainability. A prospective recycling strategy called upcycling maximizes the use of energy, raw materials, and water while minimising its negative effects on the environment. In addition, recycling textiles has a lower environmental impact than landfill disposal and textile incineration. Resource recovery can produce significant environmental benefits by replacing goods derived from primary resources. Over the course of the projection period, all of the aforementioned variables are anticipated to stimulate market expansion.

The United States has one of the greatest textile industries in the world, according to the National Council of Textile Organisation of the U.S. Additionally, the U.S. produces a significant amount of garbage from wasted textiles. The average American tosses away about 70 pounds of textiles each year, according to the Council for Textile Recycling. In the upcoming years, it is anticipated that the aforementioned reasons will increase demand for textile recycling. Additionally, it is expected that an increase in textile waste will be produced due to population growth and expanding consumer spending power, raising management issues. In order to address problems with managing textile waste and encourage the adoption of a circular economy in the nation, a number of government agencies and private businesses are looking at textile recycling. U.S. Environmental Protection Agency Report 2022 states that 14.7% of all textiles in the nation were recycled in 2018.

The average life of a given garment is getting shorter, which contributes to an increase in the production of textile and clothing waste. Due to the landfill disposal and incineration process, which results in greenhouse gas emissions, this has a significant negative influence on the environment. Recycling textiles significantly lowers greenhouse gas emissions and stimulates economic growth, claim the EPA and SMART. Furthermore, it is projected that innovations in recycling practises and ground-breaking research in the area will support market expansion. For instance, LIST Technology AG displayed a lyocell T-shirt made entirely of recycled material in February 2022 at the International Conference on Cellulose Fibres, announcing a breakthrough in the textile recycling business. Thus, driving the Textile Recycling market revenue.

Textile Recycling Market Segment Insights

Textile Recycling Material Insights

The Textile Recycling Market segmentation, based on Material, includes cotton, polyester & polyester fiber, wool, nylon & nylon fiber, and others. Cotton segment dominated the global market in 2022. Recycled cotton is a sustainable choice since it requires significantly less resources than conventional or organic cotton and reduces textile waste. Cotton is one of the main contributors to textile waste because of its high demand and widespread use in clothes and other textiles. Wool clothing has a longer shelf life and superior inherent durability in the textile industry.

Textile Recycling Textile Waste Insights

The Textile Recycling Market segmentation, based on Textile Waste, includes pre-consumer and post-consumer. The post-consumer segment dominated the global market in 2022. Clothing that has been damaged, rejected, worn out, or is no longer in style makes up post-consumer textile waste. Post-consumer textile waste includes any clothing that a consumer throws away.

Textile Recycling Distribution Channel Insights

The Textile Recycling Market segmentation, based on Distribution Channel, includes online and retail & departmental stores. Online segment dominated the Textile Recycling Market in 2022. Online sales now make up about a quarter of all retail sales, and the industry is expanding quickly. Retailers who ignore e-commerce risk having less business as more and more customers place orders online.

Textile Recycling Process Insights

The Textile Recycling Market segmentation, based on Process, includes mechanical and chemical. Mechanical segment dominated the Textile Recycling Market in 2022. This is primarily due to the fact that there are many market participants who recycle textiles mechanically rather than chemically.

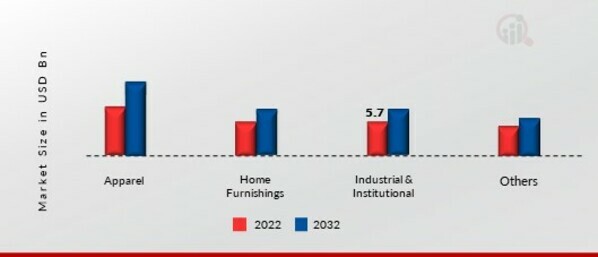

Textile Recycling End Use Industry Insights

The Textile Recycling Market segmentation, based on End Use Industry, includes apparel, home furnishings, industrial & institutional, and others. Apparel segment dominated the Textile Recycling Market in 2022. It consists, among other things, of waste generated by the excess fabric used in manufacturing, rejected or damaged clothing, and post-consumer discarded clothing and footwear. The typical lifespan of a new garment has dramatically decreased over the past 20 years, increasing the amount of trash produced by the clothes industry.

Figure 1: Textile Recycling Market, by End Use Industry, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

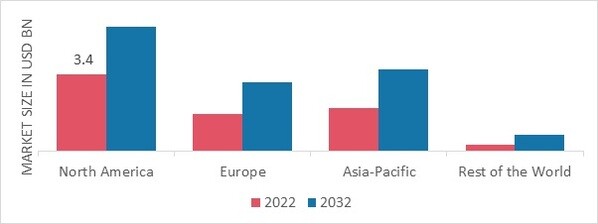

Textile Recycling Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America Textile Recycling Market dominated this market in 2022 (45.80%). An increase in consumer spending on products and services is to blame for this. Due to this, there is now a greater need in the area for textile recycling activities as well as sustainable options for managing textile waste. Further, the U.S. Textile Recycling market held the largest market share, and the Canada Textile Recycling market was the fastest growing market in the North America region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: TEXTILE RECYCLING MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Textile Recycling market accounted for the healthy market share in 2022. This is due to rising government backing from the various nations and an increase in recycling-related programmes. Further, the German Textile Recycling market held the largest market share, and the U.K Textile Recycling market was the fastest growing market in the European region

The Asia Pacific Textile Recycling market is expected to register significant growth from 2023 to 2032. Due to growing worries about the environmental effects of textile waste, expanding government initiatives for managing textile waste, and ongoing development of cutting-edge technologies for textile recycling, it is anticipated that demand for textile recycling activities will rise in this region over the course of the forecast period. Moreover, China’s Textile Recycling market held the largest market share and the Indian Textile Recycling market was the fastest growing market in the Asia-Pacific region.

Textile Recycling Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Textile Recycling market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Textile Recycling industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Textile Recycling industry to benefit clients and increase the market sector. In recent years, the Textile Recycling industry has offered some of the most significant advantages to medicine. Major players in the Textile Recycling market, including Anandi Enterprises, American Textile Recycling Service, Boer Group Recycling Solutions, I:Collect GmbH, Infinited Fiber Company, Patagonia, Prokotex, Pure Waste Textiles, Retex Textiles, and Unifi, Inc., are attempting to increase market demand by investing in research and development Materials.

For the textile and nonwovens industries, Lenzing AG (Lenzing) manufactures and sells fibres and cellulose. The company sells a variety of goods, including acetic acid, furfural, xylose, and magnesium lignin sulfonate as well as lyocell fibres, filament yarn, modal fibres, viscose fibres, pulp, and sodium sulphate. Its goods are used in the production of clothes, farming supplies, interior and hygiene items, hazard safety supplies, engineering goods, and packaging materials. Additionally, the business provides engineering, consulting, and mechanical construction services. It has manufacturing sites in the US, China, the UK, Austria, the Czech Republic, Indonesia, and Thailand.

Compagnie de Saint-Gobain (Saint-Gobain) manufactures building materials and construction-related products. Numerous varieties of glasses, ceramic tiles and associated products, plastics, pipes and associated items, home improvement supplies, gypsum, industrial mortar, roofing products, and external wall products are among the company's product lines. Additionally, the business sells performance polymers, glass textiles, and mineral ceramics. ADFORS, British Gypsum, Certainteed, CHRYSO, GCP APPLIED TECHNOLOGIES, NORTON, RIGIPS, weber, SAINT-GOBAIN, and Isover are only a few of the brands under which it sells these goods. The automotive, aerospace, health, defence, energy, security, and food and beverage industries all use Saint-Gobain products. Along with its affiliates and subsidiaries, the corporation conducts business throughout the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Key Companies in the Textile Recycling market include

- Anandi Enterprises

- American Textile Recycling Service

- Boer Group Recycling Solutions

- I:Collect GmbH

- Infinited Fiber Company

- Patagonia

- Prokotex

- Pure Waste Textiles

- Retex Textiles

- Unifi, Inc.

Textile Recycling Industry Developments

March 2022 A contract was inked by HYOSUNG TNC and TOPTEN to collaborate on the creation of high-quality environmentally friendly products.

Textile Recycling Market Segmentation

Textile Recycling Material Outlook

- Cotton

- Polyester & Polyester Fiber

- Wool

- Nylon & Nylon Fiber

- Others

Textile Recycling Textile Waste Outlook

- Pre-consumer

- Post-consumer

Textile Recycling Distribution Channel Outlook

- Online

- Retail & Departmental Stores

Textile Recycling Process Outlook

- Mechanical

- Chemical

Textile Recycling End Use Outlook

- Apparel

- Home Furnishings

- Industrial & Institutional

- Others

Textile Recycling Regional Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.