Sustainability Awareness

Growing awareness of sustainability among consumers and businesses is driving The Thailand diesel engine catalyst market. As environmental concerns become more pronounced, there is a rising demand for cleaner technologies that minimize the ecological footprint of diesel engines. This trend is reflected in the increasing adoption of catalysts that reduce harmful emissions, such as nitrogen oxides and particulate matter. The Thai government is also promoting sustainable practices through incentives for companies that invest in eco-friendly technologies. Consequently, the market is likely to see a surge in the development and deployment of catalysts that align with sustainability goals, thereby enhancing the overall environmental performance of diesel engines.

Technological Advancements

Technological advancements in catalyst design and manufacturing are reshaping The Thailand diesel engine catalyst market. Innovations such as the development of new materials and improved catalyst formulations are enhancing the efficiency and effectiveness of diesel catalysts. These advancements not only help in meeting stringent emission regulations but also contribute to better fuel economy. The introduction of nanotechnology and advanced coating techniques is enabling the production of catalysts that are more durable and effective at lower temperatures. As these technologies become more prevalent, they are likely to drive the market forward, offering manufacturers the opportunity to differentiate their products and improve performance.

Growth in Transportation Sector

The expansion of the transportation sector in Thailand is a pivotal driver for the diesel engine catalyst market. With the increasing demand for freight and passenger transport, there is a corresponding rise in diesel engine usage. According to recent statistics, the transportation sector contributes significantly to Thailand's GDP, which in turn fuels the need for efficient and compliant diesel engines. This growth necessitates the integration of advanced catalytic solutions to meet emission standards and improve engine performance. As the sector continues to evolve, the demand for high-quality diesel engine catalysts is expected to increase, presenting opportunities for manufacturers to innovate and capture market share.

Regulatory Compliance and Innovation

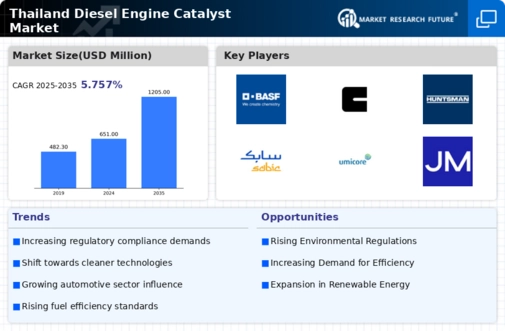

The Thailand diesel engine catalyst market is significantly influenced by stringent environmental regulations aimed at reducing emissions from diesel engines. The Thai government has implemented various policies, including the Euro 5 emission standards, which necessitate the adoption of advanced catalytic technologies. This regulatory framework encourages manufacturers to innovate and develop more efficient catalysts that comply with these standards. As a result, the market is witnessing a shift towards high-performance catalysts that not only meet regulatory requirements but also enhance fuel efficiency. The demand for such innovative solutions is expected to grow, as compliance with these regulations becomes increasingly critical for manufacturers and operators in the transportation sector.

Economic Growth and Industrialization

The ongoing economic growth and industrialization in Thailand are key factors propelling the diesel engine catalyst market. As the country continues to develop, there is an increasing demand for energy and transportation solutions that support industrial activities. This growth is accompanied by a rise in diesel engine applications across various sectors, including construction, agriculture, and logistics. The Thai government is investing in infrastructure projects, which further stimulates the demand for diesel engines and, consequently, catalysts. This trend suggests that the market for diesel engine catalysts will likely expand, driven by the need for efficient and compliant solutions that support Thailand's industrial ambitions.