Growth in Healthcare Applications

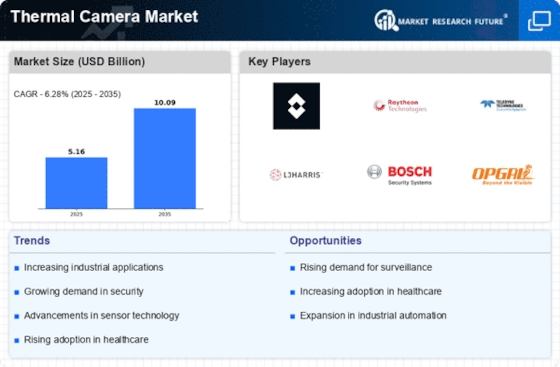

The Thermal Camera Market is witnessing significant growth in healthcare applications, particularly in diagnostics and patient monitoring. Thermal imaging technology is being increasingly utilized for non-invasive assessments, such as detecting fevers and monitoring blood flow. Hospitals and clinics are adopting thermal cameras to enhance patient care and improve operational efficiency. Recent statistics suggest that the healthcare segment is expected to grow at a rate of around 10% over the next few years, driven by the need for advanced diagnostic tools. Furthermore, the integration of thermal cameras with telemedicine platforms is likely to enhance remote patient monitoring capabilities. This trend not only improves patient outcomes but also reduces the burden on healthcare facilities. As the healthcare sector continues to evolve, the role of thermal cameras in diagnostics and monitoring is expected to expand, contributing to the overall growth of the Thermal Camera Market.

Increased Focus on Safety and Security

The Thermal Camera Market is significantly influenced by the heightened focus on safety and security across various sectors. With rising concerns over crime rates and the need for enhanced surveillance, organizations are increasingly investing in thermal imaging technology. Thermal cameras provide a distinct advantage in low-light and challenging environmental conditions, making them ideal for security applications. Recent market analysis indicates that the security segment is projected to grow at a compound annual growth rate of approximately 9% in the coming years. This growth is attributed to the increasing adoption of thermal cameras in public safety, border security, and critical infrastructure protection. As security threats evolve, the demand for advanced surveillance solutions, including thermal cameras, is likely to rise, further driving the expansion of the Thermal Camera Market.

Rising Demand in Industrial Applications

The Thermal Camera Market is experiencing a notable increase in demand driven by industrial applications. Industries such as manufacturing, oil and gas, and construction are increasingly utilizing thermal cameras for predictive maintenance, quality control, and safety inspections. The ability of thermal cameras to detect heat anomalies allows for early identification of equipment failures, thereby reducing downtime and maintenance costs. According to recent data, the industrial segment is projected to account for a substantial share of the market, with a growth rate of approximately 8% annually. This trend indicates a shift towards more proactive maintenance strategies, which are becoming essential in competitive industrial environments. As industries continue to prioritize efficiency and safety, the adoption of thermal cameras is likely to expand, further solidifying their role in the Thermal Camera Market.

Technological Innovations and Advancements

The Thermal Camera Market is propelled by continuous technological innovations and advancements in thermal imaging technology. Recent developments in sensor technology, image processing algorithms, and miniaturization have significantly enhanced the performance and affordability of thermal cameras. These advancements have made thermal imaging more accessible to a broader range of applications, including automotive, aerospace, and consumer electronics. Market data suggests that the introduction of smart thermal cameras, equipped with artificial intelligence and machine learning capabilities, is expected to revolutionize the industry. These innovations not only improve image quality but also enable real-time data analysis and decision-making. As technology continues to evolve, the Thermal Camera Market is likely to witness an influx of new products and applications, further driving market growth.

Growing Environmental Monitoring Initiatives

The Thermal Camera Market is increasingly influenced by growing environmental monitoring initiatives aimed at addressing climate change and resource management. Thermal cameras are being utilized for various applications, including wildlife monitoring, energy audits, and detecting heat loss in buildings. The ability to capture thermal data plays a crucial role in assessing environmental conditions and implementing sustainable practices. Recent reports indicate that the environmental monitoring segment is expected to grow at a rate of approximately 7% annually, driven by the increasing emphasis on sustainability and conservation efforts. As governments and organizations prioritize environmental protection, the demand for thermal cameras in monitoring applications is likely to rise, contributing to the overall expansion of the Thermal Camera Market.