Market Trends

Key Emerging Trends in the Thermal Systems Market

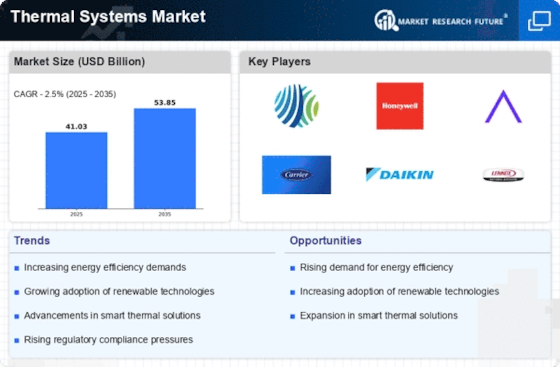

The Thermal Systems Market is witnessing several notable trends that are shaping the industry landscape. One prominent trend is the increasing focus on energy efficiency. As environmental concerns rise, there is a growing demand for thermal systems that minimize energy consumption while maintaining optimal performance. This trend is driving innovations in the development of more efficient heating, ventilation, and air conditioning (HVAC) systems, as well as other thermal solutions that contribute to sustainability goals.

Smart technology integration is another significant trend in the Thermal Systems Market. The rise of the Internet of Things (IoT) has led to the incorporation of smart and connected features in thermal systems. Consumers now seek solutions that offer remote control, automation, and data monitoring capabilities. Smart thermostats, for example, allow users to manage their HVAC systems efficiently, contributing to both convenience and energy savings. This trend aligns with the broader movement towards smart homes and buildings.

A shift towards renewable energy sources is impacting the thermal systems industry. As the focus on reducing carbon footprints intensifies, there is a growing adoption of thermal systems that utilize renewable energy, such as solar thermal heating and geothermal heating and cooling. This trend reflects a commitment to cleaner and more sustainable energy solutions, aligning with global efforts to combat climate change.

The increasing importance of indoor air quality is driving trends in the Thermal Systems Market. With a growing awareness of the impact of indoor air pollution on health, there is a heightened demand for thermal systems that prioritize air purification and filtration. HVAC systems equipped with advanced air quality monitoring and purification technologies are gaining popularity as consumers seek solutions that contribute to healthier indoor environments.

Customization and flexibility are emerging as key trends in the Thermal Systems Market. Consumers and businesses are looking for thermal solutions that can be tailored to specific needs and applications. This trend is reflected in the development of modular and customizable HVAC systems, allowing users to adapt thermal solutions to the unique requirements of their spaces. Flexibility in design and functionality is becoming a competitive advantage in the market.

Resilience and reliability are crucial considerations in the thermal systems industry, and this has given rise to the trend of incorporating backup and redundancy features. With the increasing frequency of extreme weather events and power outages, there is a growing demand for thermal systems that can operate seamlessly under challenging conditions. Solutions with built-in redundancy and backup capabilities provide users with a sense of security and continuity.

The adoption of Building Information Modeling (BIM) technology is transforming how thermal systems are designed and implemented. BIM allows for more accurate and collaborative planning, design, and construction processes. Thermal systems integrated with BIM facilitate better coordination among different stakeholders in construction projects, leading to more efficient and effective outcomes.

Leave a Comment