Leading market players are investing heavily in the research and development in order to expand their product lines, which will help the Thermal Systems Market grow even more. Market players are also undertaking a variety of strategic activities to spread their global footprint, with important market developments including mergers and acquisitions, new product launches, contractual agreements, higher investments, and collaboration with other organizations. To spread and survive in a more competitive and rising market climate, the Thermal Systems industry must offer cost-effective items.

Manufacturing locally to minimize the operational costs is one of the key business tactics used by the manufacturers in the global Thermal Systems industry to benefit the clients and increase the market sector. In recent years, the Thermal Systems industry has offered some of the most significant advantages to several industries.

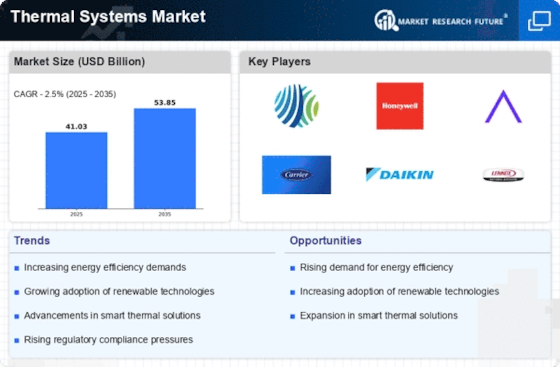

Major players in the Thermal Systems Market, including 3M, Intel Corporation, Parker Hannifin Corporation, Honeywell International Inc., Siemens AG, Johnson Controls International Plc, Emerson Electric Co., Schneider Electric SE, Daikin Industries, Ltd, Mitsubishi Electric Corporation, and others, are attempting to increase market demand by investing in the research and development operations.

3M, officially known as the Minnesota Mining and Manufacturing Company, is a multinational conglomerate with a diverse portfolio of products and technologies. 3M has evolved into a global innovation powerhouse. The company is renowned for its commitment to research and development, producing a wide array of solutions that span multiple industries, including healthcare, transportation, consumer goods, and electronics.

In January 3M Company announced that it had acquired C&H Technologies for US$9.3 billion. C&H Technologies is a leading provider of critical environment solutions, including thermal management solutions. The acquisition is expected to close in the second half of 2023.

These are just a few examples of the recent acquisitions and partnerships in the thermal systems market. The market is expected to continue to consolidate in the coming years as companies look to spread their product offerings and gain access to new technologies.

Intel Corporation is a global technology company that holds a prominent position in the semiconductor industry. Founded in 1968, Intel has become one of the world's largest and most influential semiconductor chip manufacturers. Intel's contributions to the technology landscape go beyond microprocessors; the company is involved in various areas, including memory products, networking solutions, and other semiconductor-based technologies. Intel's x86 architecture has been a standard in the computing industry for several decades. The company has played a crucial role in driving advancements in computing and technology, fostering the development of faster, more efficient, and powerful processors.

Intel Corporation announced on December 21, 2022, that it had acquired Tower Semiconductor Ltd. for US$5.4 billion. Tower Semiconductor is a leading foundry that manufactures semiconductors for a variety of applications, including automotive, industrial, and consumer electronics. The acquisition is expected to close in the second half of 2023.