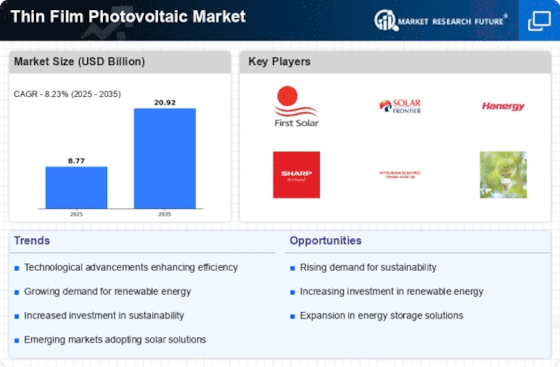

Market Share

Thin Film Photovoltaic Market Share Analysis

Rapid urbanization and the shift from conventional power towards renewable ones have increased demand for mass producing energies necessitating needs for thin film photovoltaics; growing energy substantial markets; increasing interest for efficient remedies. These include China, India, and South Korea where wealth accumulation has led them becoming major buyers of green power.In addition, they are also responsible for high air pollution levels caused by coal-based thermal plants. India plans to scale up renewable generation to 175 GW by 2022 while out of these 100 GW will be sourced from solar alone.

By giving various incentives to the equipment suppliers and developers of solar plants, the government is encouraging solar power. Solar energy production in China has grown in leaps and bounds making it the world’s largest producer of solar energy. Per IEA, China accounts for about half of all global solar PV demand while Chinese companies contribute 60% of the total annual manufacturing capacity for solar cell.Thin film photovoltaic (PV) market trends are moving towards reflecting changing solar energy technology. One trend that stands out is a rising interest in next-generation thin film materials.

Traditional thin film technologies like amorphous silicon have been dominant in the market, however emerging materials such as cadmium telluride (CdTe), copper indium gallium selenide (CIGS), perovskite etc., are becoming popular because they have potential to enhance efficiency and reduce manufacturing costs. This shows a continued drive for innovation within the sector to make it more competitive.

The direction is towards building-integrated photovoltaics (BIPV) where structures are made of thin-film solar materials. This development agrees with an upward push concerning environment friendliness in building industry as well as urban design. Thin-film BIPV offers architects and real estate developers flexibility to bring into play solar components on buildings’ facades, windows or other surfaces incorporating aesthetic quality as well as electrical power generation capabilities. Such integration supports widespread use of renewable energy resources within city areas.

Furthermore, there is a notable trend towards flexible and lightweight thin film solar modules. CIGS based flexible CIGS or organic photovoltaics etc., enable flexibility which allows them to be used even on irregular surfaces.This line of products can be used on curved structures or those with odd shapes hence their application can range from portable solar devices to flexible panels for vehicles or light remote area solutions.

Grid parity - The point at which the cost of electricity generated from thin-film PV is equal to or lower than that of conventional sources, is one of the major trends shaping market dynamics. Thin film PV systems are becoming more cost-effective as manufacturing costs continue to decrease and efficiency improves. Hence this trend is helping to increase the popularity of thin-film solar technologies thereby providing a path for wide scale adoption in utility-scale solar projects and distributed generation ones. Another emerging trend in the thin-film photovoltaic market is energy storage integration.As demand increases for reliable dispatchable power from solar, so does relevance of integrating battery technologies within thin film PV systems.The intermittent nature of solar energy supplies has been addressed by seeking ways through which more resilient and dependable installations can be achieved.

Leave a Comment