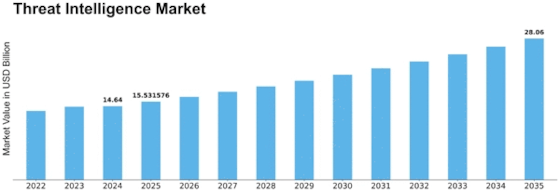

Threat Intelligence Size

Threat Intelligence Market Growth Projections and Opportunities

In the rapidly evolving landscape of the Threat Intelligence market, companies employ various strategies to establish their market share and gain a competitive edge. One primary approach is differentiation, where companies focus on offering unique features and capabilities in their Threat Intelligence solutions. This may include advanced threat detection algorithms, real-time analysis capabilities, or specialized threat intelligence feeds tailored to specific industry verticals. Through emphasizing these unique characteristics of the company, it aims to win the clients who are searching for sophisticated and customized threat intelligence solutions the industry. This way, it could stand out of the crowd. Another popular approach in the Threat Intelligence is going with the cost leadership strategy. For this approach, companies focus on becoming a low-cost provider by utilizing advanced operational processes, locking in rates on data sources, and implementing sound cost management systems. Competitive pricing is what these companies use to attract customers of all classes - especially those most concerned with cost-effectiveness in the course of their cybersecurity efforts as compared to features or premium services. Market penetration strategies are of a key importance in the process of Threat Intelligence providers' outreach expansion. This also involves market penetration that is intensive marketing, exploring new geographical markets and unexploited customer segments. As the leading organizations understand the necessity of robust threat intelligence in support of their cybersecurity posture, companies that implement this strategy aim at getting a strong foothold in the emerging markets.They demand more than their fair share of the overall Threat Intelligence market. Similarly, although partnerships and cooperation are other channels to access the Threat Intelligence market. Under the form of partnerships with competitors such as cybersecurity solution providers, technology vendors, or industry-specific organizations, the companies can develop comprehensive threat intelligence solutions, extent service offerings, and consolidated threat intelligence data. Being that such cooperation enables organizations to aggregate resources and expertise, which in the end deepens their competitiveness, the cybersecurity landscape currently presents unique but ever-evolving challenges. For this reason, innovations are driving market share positioning in the Threat Intelligence market. Companies invest in research and development to stay at the forefront of technological advancements, continuously improving threat detection capabilities, enhancing data analysis techniques, and adapting to the evolving tactics of cyber threats. By consistently innovating, companies not only differentiate themselves from competitors but also ensure the relevance and competitiveness of their Threat Intelligence solutions in an ever-changing threat landscape.

Leave a Comment