The Threat Intelligence Market is currently experiencing a dynamic evolution, driven by the increasing complexity of cyber threats and the growing need for organizations to safeguard their digital assets. As businesses become more reliant on technology, the demand for advanced threat intelligence solutions appears to be escalating. This market encompasses a wide range of services and products designed to identify, analyze, and mitigate potential security risks. Organizations are increasingly recognizing the value of proactive threat intelligence in enhancing their cybersecurity posture, which may lead to a more robust defense against evolving threats.

Moreover, the integration of artificial intelligence and machine learning technologies into threat intelligence solutions is likely to transform the landscape. These innovations may enable organizations to process vast amounts of data more efficiently, allowing for quicker identification of threats and more effective responses. As the Threat Intelligence Market continues to mature, collaboration among various stakeholders, including government agencies, private sector companies, and cybersecurity firms, seems essential for fostering a comprehensive approach to threat management. This collaborative effort could enhance the overall effectiveness of threat intelligence initiatives, ultimately contributing to a safer digital environment for all stakeholders involved.

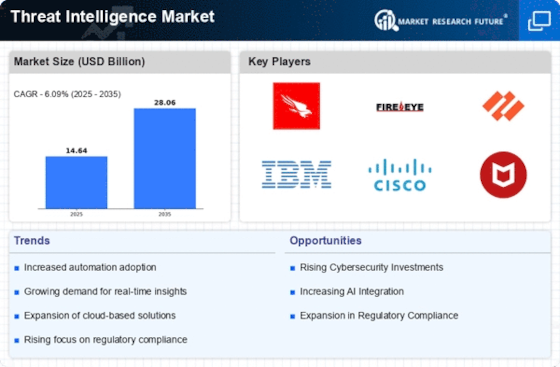

This Threat Intelligence Report provides a comprehensive analysis of the global threat intelligence market, highlighting key trends, growth drivers, and the evolving role of digital threat intelligence in modern cybersecurity strategies. Advancements in cyber threat intelligence analytics and ongoing threat intelligence research are enabling organizations to transform raw threat data into actionable insights, strengthening global threat intelligence capabilities. Large organizations are increasingly adopting enterprise threat intelligence solutions to support business threat intelligence and corporate threat intelligence initiatives across BFSI, healthcare, and IT sectors. The threat intelligence platform market continues to expand as organizations invest in integrated platforms, with threat intelligence platform market analysis indicating rising demand for scalable solutions and increasing market share among cloud-based providers.

Increased Adoption of AI and Machine Learning

The integration of artificial intelligence and machine learning into threat intelligence solutions is becoming more prevalent. These technologies enable organizations to analyze large datasets rapidly, improving the accuracy and speed of threat detection. As a result, businesses are likely to enhance their ability to respond to emerging threats effectively.

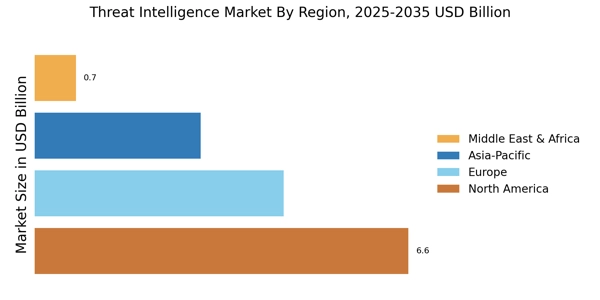

The expansion of the threat intelligence security market is closely linked to the growth of the threat intelligence management market, as enterprises prioritize centralized threat monitoring and response mechanisms. Insights from this global threat intelligence report highlight regional disparities in adoption, with North America leading innovation in advanced global threat intelligence frameworks. Recent cyber threat intelligence reports and independent cyber intelligence reports indicate a shift toward AI-driven threat detection and predictive security models. The growth of the threat hunting market complements the Threat Intelligence Market, as organizations move toward proactive threat identification and response strategies. Threat intelligence is expected to play a pivotal role in shaping the future of computer security, enabling organizations to anticipate and mitigate emerging cyber risks.

Focus on Real-Time Threat Intelligence Market

Organizations are increasingly prioritizing real-time threat intelligence to stay ahead of potential cyber threats. This trend indicates a shift towards more immediate data analysis and response mechanisms, allowing companies to react swiftly to incidents and minimize potential damage.

Collaboration Among Stakeholders

There appears to be a growing emphasis on collaboration between various stakeholders in the Threat Intelligence Market. Partnerships among government entities, private companies, and cybersecurity firms may foster a more comprehensive approach to threat management, enhancing the overall effectiveness of intelligence-sharing initiatives.