Rising Cyber Threats

The threat intelligence market is experiencing growth due to the increasing frequency and sophistication of cyber threats in the UK. Cybercriminals are employing advanced tactics, leading to significant financial losses for businesses. In 2025, it is estimated that cybercrime could cost the UK economy over £27 billion annually. This alarming trend compels organizations to invest in threat intelligence solutions to proactively identify and mitigate risks. The demand for real-time threat data and analysis is surging, as companies seek to protect sensitive information and maintain operational integrity. Consequently, the threat intelligence market is likely to expand as businesses prioritize cybersecurity measures to safeguard their assets.

Regulatory Compliance Requirements

The threat intelligence market is significantly influenced by the stringent regulatory landscape in the UK. Organizations are mandated to comply with various data protection regulations, such as the General Data Protection Regulation (GDPR) and the Data Protection Act. Non-compliance can result in hefty fines, reaching up to £17 million or 4% of annual global turnover, whichever is higher. As a result, businesses are increasingly turning to threat intelligence solutions to ensure compliance and protect customer data. The need for continuous monitoring and reporting of potential threats is driving the demand for advanced threat intelligence services, thereby propelling market growth.

Increased Awareness of Cybersecurity Risks

There is a growing awareness among UK businesses regarding the potential risks associated with cyber threats, which is positively impacting the threat intelligence market. As high-profile data breaches and cyberattacks make headlines, organizations are recognizing the importance of investing in robust cybersecurity measures. Surveys indicate that approximately 70% of UK businesses consider cybersecurity a top priority. This heightened awareness is leading to increased budgets for threat intelligence solutions, as companies seek to enhance their security posture. The threat intelligence market is likely to benefit from this trend, as organizations strive to stay ahead of evolving cyber threats.

Growing Demand for Managed Security Services

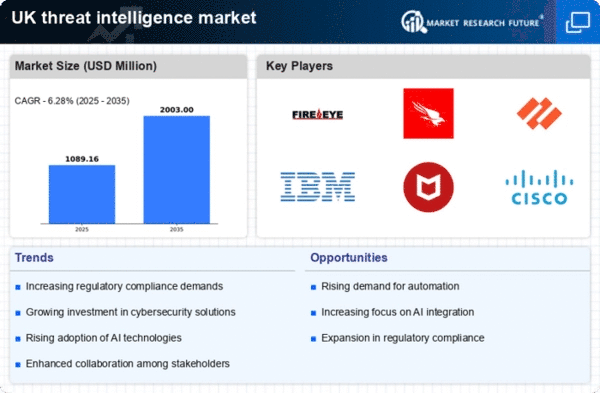

The threat intelligence market is seeing increased demand for managed security services (MSS) as organizations look to outsource their cybersecurity needs. Many UK businesses, particularly small and medium-sized enterprises (SMEs), lack the resources and expertise to manage complex security environments. MSS providers offer comprehensive threat intelligence solutions, enabling organizations to benefit from expert insights and proactive threat management. The managed security services market in the UK is anticipated to grow at a CAGR of over 12% through 2025. This trend indicates a shift towards outsourcing cybersecurity functions, which is likely to bolster the threat intelligence market as more companies seek external support to enhance their security frameworks.

Technological Advancements in Threat Detection

The threat intelligence market is being driven by rapid technological advancements in threat detection and response capabilities. Innovations in artificial intelligence (AI) and machine learning (ML) are enabling organizations to analyze vast amounts of data and identify potential threats more efficiently. In 2025, it is projected that the AI-driven cybersecurity market in the UK will reach approximately £3 billion. These technologies allow for real-time threat analysis and automated responses, significantly reducing the time taken to address security incidents. As businesses increasingly adopt these advanced technologies, the demand for threat intelligence solutions is expected to rise, further propelling market growth.