Timber Logistic Market Summary

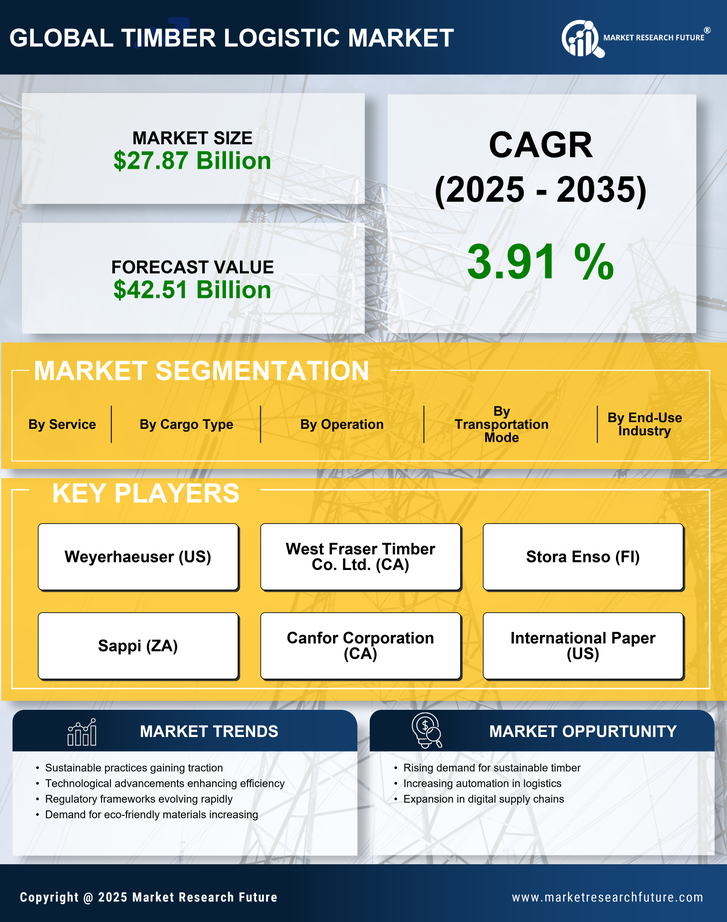

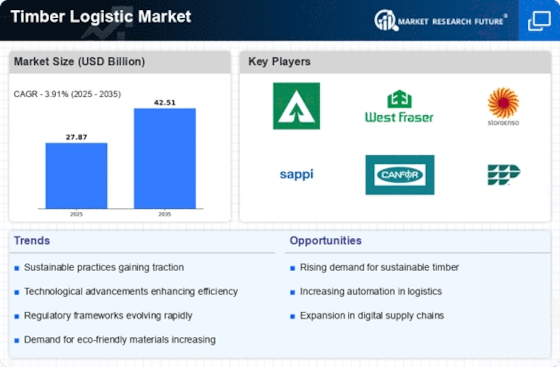

As per Market Research Future analysis, the Timber Logistic Market Size was estimated at 27.87 USD Billion in 2024. The Timber Logistic industry is projected to grow from 28.96 USD Billion in 2025 to 42.51 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.91% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Timber Logistic Market is experiencing a dynamic shift towards sustainability and technological integration.

- Technological integration is reshaping logistics operations, enhancing efficiency and transparency in the Timber Logistic Market.

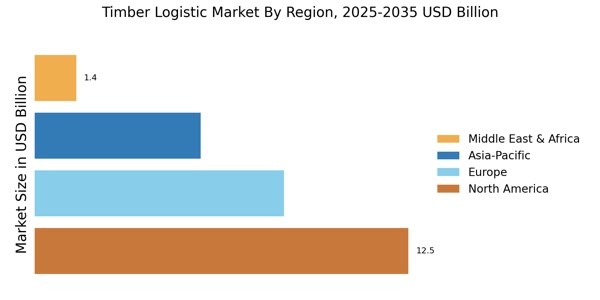

- Sustainability initiatives are increasingly influencing sourcing decisions, particularly in North America, the largest market for timber logistics.

- Logs remain the largest segment, while wood chips are emerging as the fastest-growing segment in the market.

- Rising demand for timber products and advancements in logistics technology are key drivers propelling growth in both North America and the Asia-Pacific region.

Market Size & Forecast

| 2024 Market Size | 27.87 (USD Billion) |

| 2035 Market Size | 42.51 (USD Billion) |

| CAGR (2025 - 2035) | 3.91% |

Major Players

Weyerhaeuser (US), West Fraser Timber Co. Ltd. (CA), Stora Enso (FI), Sappi (ZA), Canfor Corporation (CA), International Paper (US), Metsa Group (FI), Georgia-Pacific LLC (US), Smurfit Kappa Group (IE)