Market Analysis

In-depth Analysis of Tire Changing Machines Market Industry Landscape

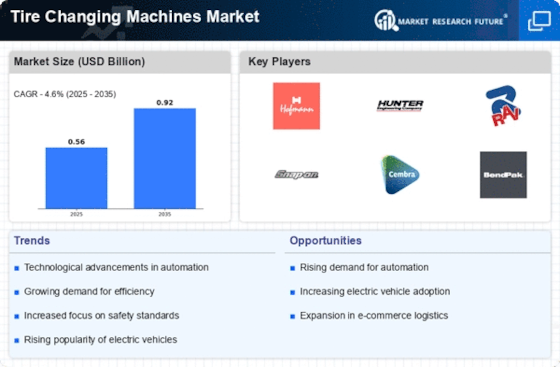

The market dynamics of tire changing machines have witnessed a notable evolution, driven by technological advancements, automotive industry trends, and the need for efficiency in tire maintenance. Tire changing machines play a crucial role in the automotive service sector, providing a faster and more streamlined process for replacing tires. The market is marked by a mix of established manufacturers, innovative startups, and advancements in automation technology.

Established manufacturers in the automotive equipment industry have adapted to the changing landscape by incorporating cutting-edge technology into their tire changing machines. These companies leverage their experience and expertise to offer reliable and efficient solutions, catering to the diverse needs of auto repair shops and service centers. The integration of features such as touchless technology, automatic bead breaking, and advanced bead seating systems reflects the industry's commitment to enhancing the efficiency and safety of tire-changing processes.

In parallel, startups are entering the market with innovative and disruptive solutions. These companies often focus on introducing compact and user-friendly tire changing machines, catering to smaller automotive service providers and DIY enthusiasts. The dynamic nature of the market encourages continuous innovation, pushing manufacturers to develop machines that not only improve the speed of tire changing but also address the evolving needs of the automotive industry.

Automation is a key trend shaping the market dynamics of tire changing machines. With the increasing emphasis on reducing manual labor and enhancing precision, automated tire changers have gained popularity. These machines utilize robotic arms and sensors to perform tire-changing tasks with minimal human intervention. The automation trend not only improves the speed and accuracy of tire changing but also contributes to the overall safety of the process, reducing the risk of injuries and errors.

The tire changing machine market is also influenced by the broader trends in the automotive industry, such as the shift towards electric and hybrid vehicles. As electric vehicles become more prevalent, tire changing machines need to adapt to the unique characteristics of electric vehicle tires, which often feature different designs and materials. This trend presents both challenges and opportunities for manufacturers to develop tire changing machines that cater to the specific requirements of electric and hybrid vehicles.

The aftermarket segment plays a significant role in the market dynamics of tire changing machines. As vehicles on the road continue to age, the demand for tire replacement and maintenance services in the aftermarket grows. This has led to an increased adoption of tire changing machines by independent tire shops and service centers. Additionally, the availability of a wide range of tire options, including specialty tires for various vehicles, further contributes to the demand for versatile and adaptable tire changing machines.

Environmental considerations also play a role in shaping the market dynamics of tire changing machines. Manufacturers are increasingly focusing on developing machines that are energy-efficient and environmentally friendly. This includes the use of eco-friendly materials in machine construction and the incorporation of energy-saving features, aligning with global efforts towards sustainability and reduced environmental impact.

The market dynamics of tire changing machines are characterized by a combination of technological innovation, automation trends, and industry-specific considerations. Established manufacturers and startups alike are contributing to a competitive landscape that fosters continuous improvement in tire-changing processes. As the automotive industry evolves, the tire changing machine market will likely see further advancements, catering to the changing needs of vehicle owners, service providers, and the broader automotive ecosystem.

Leave a Comment