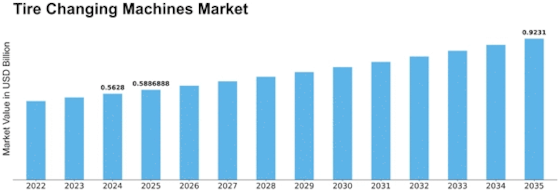

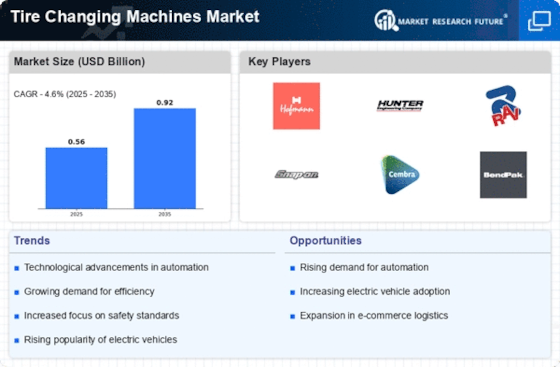

Tire Changing Machines Size

Tire Changing Machines Market Growth Projections and Opportunities

The market for tire-changing machines is influenced by several factors that cater to the needs of the automotive industry and tire service providers. One crucial market factor is the constant evolution of automotive technology, leading to diverse tire sizes and complexities. As vehicles become more advanced, tire-changing machines need to adapt to handle a variety of tire dimensions, including low-profile and run-flat tires. Manufacturers in the tire-changing machine market invest in research and development to create versatile machines capable of accommodating the changing landscape of tire technologies.

The overall growth of the automotive industry is another key driver for the tire-changing machine market. As the number of vehicles on the road increases, so does the demand for tire-related services. Tire service providers, including automotive repair shops and tire retailers, seek efficient and high-performance tire-changing machines to meet the rising demand for tire replacements and repairs. The correlation between automotive industry growth and the demand for tire-changing machines underscores the importance of this factor in shaping the market.

Technological advancements in tire-changing machines contribute significantly to the market's dynamics. Modern tire-changing machines come equipped with advanced features such as automatic bead loosening, rim clamping, and integrated pneumatic systems. These technological enhancements not only improve the efficiency and speed of tire-changing processes but also reduce the physical strain on operators. The integration of digital displays and automated systems enhances the user experience, making tire-changing machines more user-friendly and accessible to a wider range of operators.

Regulatory standards and safety considerations are critical factors influencing the tire-changing machine market. As workplace safety becomes a priority, manufacturers must adhere to safety standards and regulations to ensure the well-being of operators. Compliance with safety guidelines and the incorporation of safety features, such as protective guards and automatic shut-off mechanisms, are crucial in maintaining market credibility and meeting the expectations of both end-users and regulatory bodies.

The overall economic landscape plays a role in shaping the tire-changing machine market. Economic fluctuations impact the purchasing power of businesses and individuals, influencing investment decisions in automotive-related services. During periods of economic growth, there is typically an increase in vehicle ownership and maintenance activities, positively impacting the demand for tire-changing machines. Conversely, economic downturns may lead to a slowdown in automotive services, affecting the market for tire-changing machines.

Environmental considerations and sustainability are emerging as influential factors in the tire-changing machine market. As the automotive industry explores eco-friendly practices, tire service providers may seek machines that incorporate energy-efficient technologies or those designed with recyclability in mind. Manufacturers that align their products with environmental sustainability trends may find a competitive edge in the market as businesses and consumers increasingly prioritize environmentally conscious choices.

The digitalization of tire services and the adoption of e-commerce platforms also contribute to the market dynamics of tire-changing machines. Online tire sales and appointment scheduling platforms drive the demand for efficient tire-changing processes. Tire service providers may invest in machines that offer compatibility with digital systems, streamlining operations and enhancing customer experience in an increasingly digitized automotive service landscape.

The market for tire-changing machines is influenced by a combination of factors, including technological advancements, the growth of the automotive industry, regulatory standards, economic conditions, environmental considerations, and the digitalization of tire services. Manufacturers and service providers in this sector must stay attuned to these market factors to meet the evolving demands of the automotive landscape and provide efficient, safe, and technologically advanced solutions for tire changing.

Leave a Comment