Research Methodology on Titanium Alloys Market

Introduction

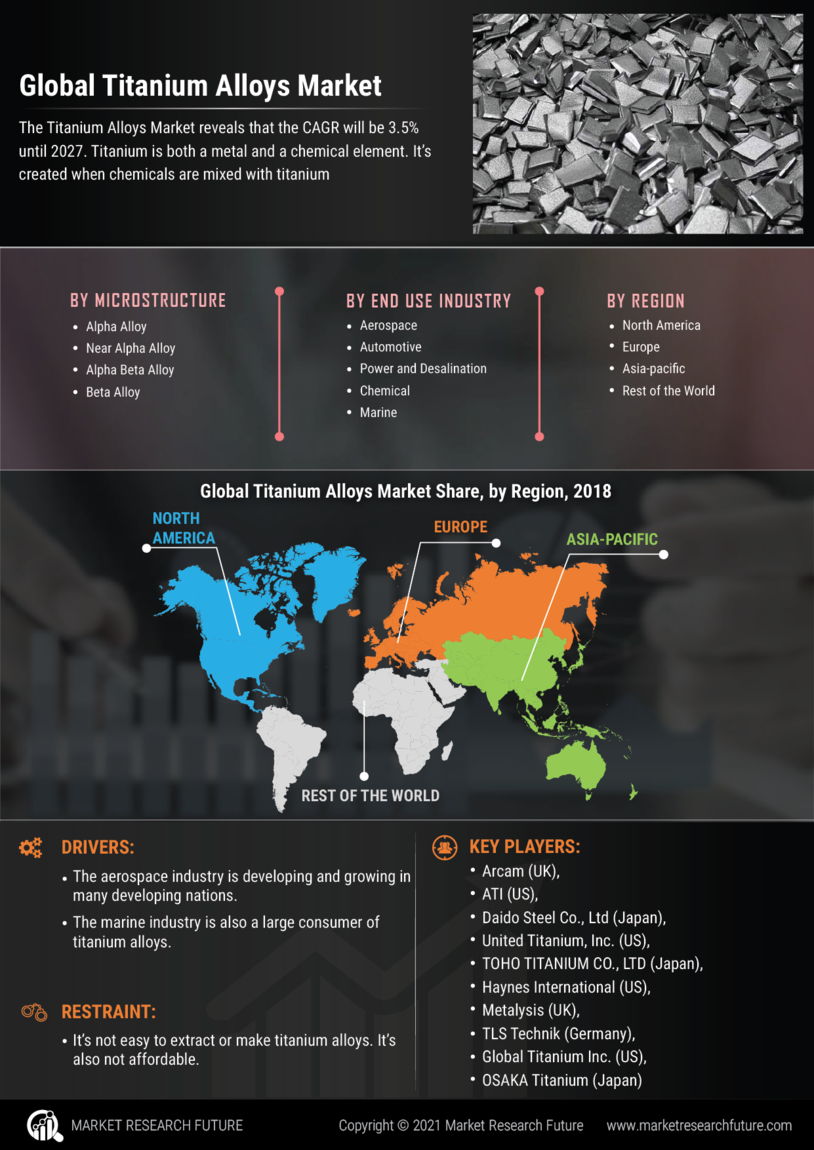

The rapid growth of the medical industry, construction industry and other industries are the key drivers for increasing demand for titanium alloys in various applications. The development of new alloy grades further provides growth opportunities for the market.

Research Methodology

For the present study, extensive research has been carried out. Both primary and secondary research were employed for a comprehensive and detailed study. The primary data for the study were gathered in two ways:

A) Secondary Research

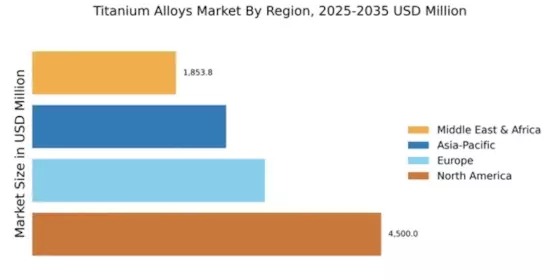

For this research, several educational as well as industry sources such as magazines and periodicals, industry reports, websites, industry databases and journals were chosen for the secondary data collection. The information from these sources was collected, assimilated and then analysed to understand the current scenario of the titanium alloys market. In addition to this, the detailed market size of the key segments of the titanium alloys market, geographic analysis, companies active in the industry and the value chain of the titanium alloys industry were also assessed and studied in detail.

B) Primary Research

To study the titanium alloys market in detail, primary data was collected by conducting interviews with the industry experts of the titanium alloys market, including customers, investors, stakeholders and other employees involved in different stages of product development. This included understanding the current market trends, factors driving and hindering the growth of the industry, anticipated technological developments, pricing analysis and much more.

Data analysis

Once the data is collected, various software tools were used for data analysis and interpretation. A variety of tools such as regression models, linear programming models and economic forecasting models were used to study the statistical data. These tools enabled the researchers to identify emerging trends, changing strategies and to discover the underlying patterns and relationships from the data. The research also used qualitative tools such as focus groups, surveys and interviews with experts to gain valuable insights into the market.

Sampling

The sample for the study was selected to represent the opinion of professionals, industry experts and customers. The sampling was conducted in two stages. First, a comprehensive list of target companies and individuals was compiled. Then, a sample was selected from the list after a diligent screening process to ensure its quality and objectivity.

Conclusion

This research provides a comprehensive view of the current market of titanium alloys. This research is an exhaustive overview of the current trends, opportunities, industry dynamics and more related to the specific market. It is beneficial for the customers, stakeholders, investors and other stakeholders to understand the current trends and scenarios in the market and to create strategies to stay competitive in the industry. The research also helps industry experts to develop new strategies and to identify opportunities in the market.