Rising Adoption of Smart Devices

The increasing prevalence of smart devices is a pivotal driver for the Touch Sensor Market. As consumers gravitate towards smartphones, tablets, and smart home devices, the demand for touch sensors is expected to surge. In 2025, the market for smart devices is projected to reach approximately 1.5 billion units, which could significantly bolster the touch sensor segment. This trend indicates a shift towards more intuitive user interfaces, where touch sensors play a crucial role in enhancing user experience. Manufacturers are likely to invest in advanced touch technology to meet consumer expectations, thereby propelling the Touch Sensor Market forward. Furthermore, the integration of touch sensors in various applications, including automotive and industrial sectors, suggests a broadening scope for market growth.

Expansion of Automotive Applications

The automotive sector is increasingly adopting touch sensor technology, which serves as a significant driver for the Touch Sensor Market. With the rise of electric and autonomous vehicles, touch sensors are being integrated into dashboards, infotainment systems, and control panels. By 2025, it is estimated that the automotive segment will contribute nearly 25% to the overall touch sensor market revenue. This trend indicates a shift towards more interactive and user-friendly interfaces in vehicles, enhancing driver and passenger experiences. As automotive manufacturers prioritize safety and convenience, the demand for touch sensors is expected to grow, thereby reinforcing the Touch Sensor Market's position in the automotive landscape.

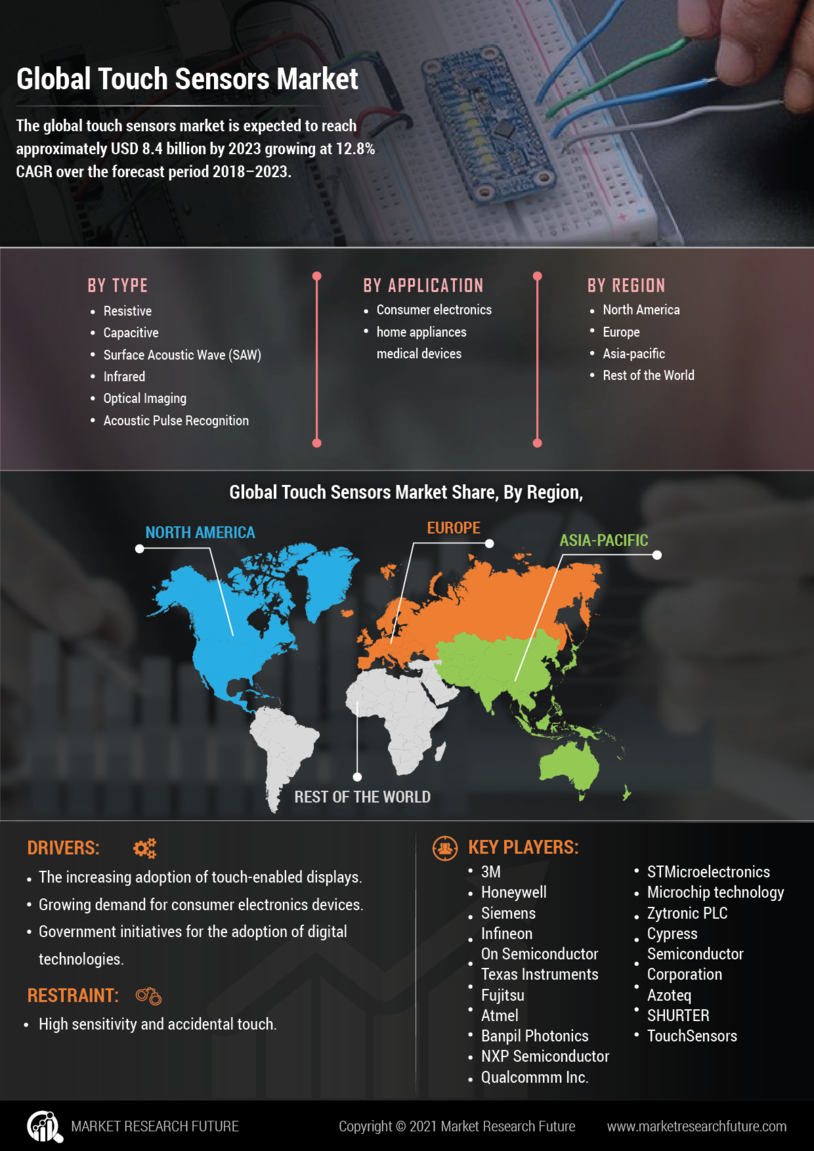

Technological Innovations in Touch Sensors

Technological advancements are transforming the Touch Sensor Market, leading to the development of more efficient and versatile sensors. Innovations such as capacitive touch technology and multi-touch capabilities are enhancing the functionality of touch sensors. In 2025, the market for capacitive touch sensors is anticipated to account for over 40% of the total touch sensor market, reflecting a growing preference for this technology. These advancements not only improve responsiveness but also reduce power consumption, making them suitable for a wider range of applications. As manufacturers continue to innovate, the Touch Sensor Market is likely to witness the introduction of new materials and designs that further enhance performance and durability, thereby attracting more consumers.

Growing Demand for Touch Sensors in Healthcare

The healthcare sector's increasing reliance on touch sensor technology is a notable driver for the Touch Sensor Market. Touch sensors are being utilized in medical devices, patient monitoring systems, and diagnostic equipment, enhancing the efficiency and accuracy of healthcare delivery. In 2025, the healthcare application segment is projected to account for approximately 20% of the total touch sensor market. This growth is attributed to the need for more intuitive interfaces in medical devices, which can improve patient outcomes and streamline operations. As healthcare providers seek to adopt advanced technologies, the Touch Sensor Market is likely to benefit from this trend, leading to further innovations and applications in the sector.

Consumer Preference for Enhanced User Interfaces

Consumer preferences are shifting towards devices with enhanced user interfaces, driving the Touch Sensor Market. As users demand more seamless and interactive experiences, manufacturers are increasingly incorporating touch sensors into their products. This trend is evident in various sectors, including consumer electronics, home appliances, and industrial equipment. By 2025, it is anticipated that the demand for touch-enabled devices will grow by over 30%, reflecting a strong inclination towards touch technology. This consumer behavior suggests that companies must prioritize touch sensor integration to remain competitive. Consequently, the Touch Sensor Market is likely to expand as manufacturers respond to these evolving consumer expectations, leading to a proliferation of touch-enabled products.