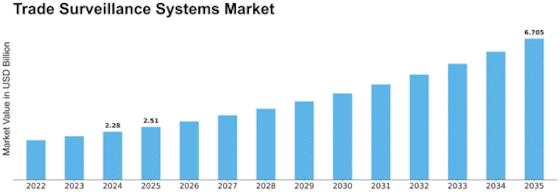

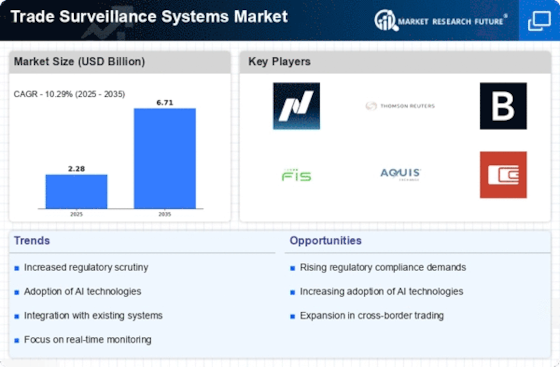

Trade Surveillance Systems Size

Trade Surveillance Systems Market Growth Projections and Opportunities

The trade surveillance systems market is influenced by various market factors that shape its growth, adoption, and evolution. One critical factor is the continually evolving regulatory landscape in the financial industry. As financial authorities worldwide tighten regulations to maintain market integrity and protect investors, there is a growing need for advanced trade surveillance systems to ensure compliance. The dynamic and ever-changing nature of regulations necessitates continuous updates and enhancements to surveillance systems, reflecting the industry's commitment to adapting to regulatory requirements and mitigating compliance risks.

Technological advancements and the integration of artificial intelligence (AI) and machine learning (ML) are pivotal market factors driving the adoption of trade surveillance systems. The sophistication of trading strategies and the sheer volume of market data make it imperative for surveillance systems to leverage advanced technologies. AI and ML empower these systems to analyze vast datasets, detect complex patterns, and adapt to evolving market conditions. This factor underscores the industry's recognition of the transformative capabilities of these technologies in enhancing surveillance accuracy and efficiency.

The proliferation of electronic trading platforms and alternative trading venues is a significant market factor influencing the trade surveillance systems landscape. As trading activities become more dispersed across various platforms, including dark pools and electronic communication networks (ECNs), surveillance systems need to provide comprehensive coverage. This market factor reflects the industry's response to the increasing complexity of the trading environment, emphasizing the need for surveillance systems that can monitor and analyze diverse trading activities across multiple venues.

Operational efficiency and risk management considerations are crucial market factors in the adoption of trade surveillance systems. Financial institutions seek to optimize their operations, manage risks effectively, and safeguard market integrity. Surveillance systems play a pivotal role in achieving these objectives by providing real-time monitoring, alerting, and reporting capabilities. This market factor aligns with the industry's focus on enhancing operational resilience and ensuring robust risk management practices in the dynamic financial landscape.

The global nature of financial markets and the interconnectedness of trading activities across borders are significant market factors shaping the adoption of trade surveillance systems. As trading becomes increasingly globalized, surveillance systems must be capable of monitoring and analyzing activities in different jurisdictions. This factor highlights the industry's acknowledgment of the need for surveillance solutions with international capabilities to address cross-border trading complexities and comply with diverse regulatory requirements.

Market abuse and fraud prevention constitute critical market factors influencing the adoption of trade surveillance systems. The sophistication of market abuses, such as insider trading, market manipulation, and fraudulent activities, necessitates vigilant monitoring and detection mechanisms. Surveillance systems are designed to identify irregularities and potential abuses, contributing to the industry's efforts to maintain market integrity and protect investors from fraudulent activities.

The demand for real-time analytics and actionable insights is a driving market factor in the adoption of trade surveillance systems. As market participants seek timely information to make informed decisions, surveillance systems play a crucial role in providing real-time data analysis and actionable insights. This market factor reflects the industry's emphasis on agility and responsiveness in the face of rapidly changing market conditions, enabling timely interventions and risk mitigation.

Cost considerations and scalability are important market factors influencing the adoption of trade surveillance systems. Financial institutions weigh the costs of implementing and maintaining surveillance systems against the potential benefits, considering factors such as scalability and flexibility. The ability of surveillance systems to scale with the growing volumes of trading data and adapt to changing business requirements is crucial. This market factor aligns with the industry's focus on optimizing resource allocation and achieving cost-effective surveillance solutions.

Leave a Comment