Transfer Membrane Market Summary

As per Market Research Future analysis, the Transfer Membrane Market Size was estimated at 0.48 USD Billion in 2024. The Transfer Membrane industry is projected to grow from USD 0.4998 Billion in 2025 to USD 0.7485 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.12% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Transfer Membrane Market is poised for substantial growth driven by technological advancements and increasing demand across various sectors.

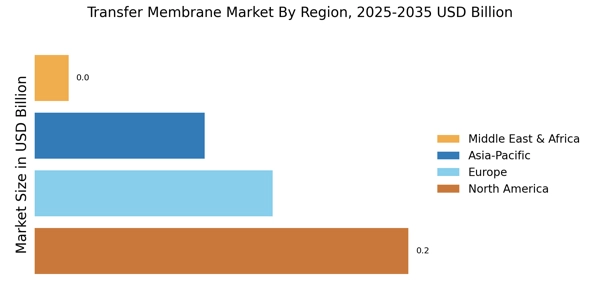

- North America remains the largest market for transfer membranes, driven by robust healthcare and industrial applications.

- Asia-Pacific is emerging as the fastest-growing region, fueled by rapid technological adoption and increasing investments in research and development.

- Nitrocellulose transfer membranes dominate the market, while PVDF transfer membranes are experiencing the fastest growth due to their superior properties.

- Technological advancements and sustainability initiatives are key drivers propelling the market forward, particularly in healthcare applications.

Market Size & Forecast

| 2024 Market Size | 0.48 (USD Billion) |

| 2035 Market Size | 0.7485 (USD Billion) |

| CAGR (2025 - 2035) | 4.12% |

Major Players

Merck KGaA (DE), Pall Corporation (US), GE Healthcare (US), Thermo Fisher Scientific (US), Sartorius AG (DE), MilliporeSigma (US), Asahi Kasei Corporation (JP), Repligen Corporation (US), Danaher Corporation (US), 3M Company (US)