Rising Electricity Demand

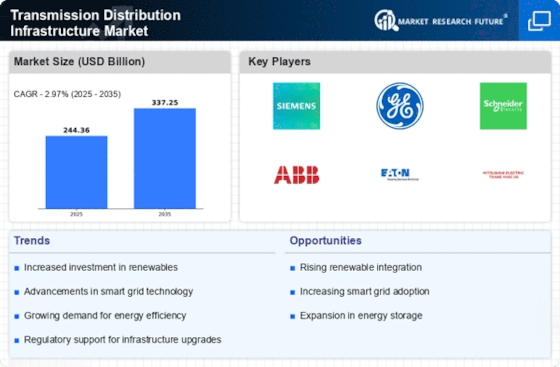

Rising electricity demand is a fundamental driver of the Transmission Distribution Infrastructure Market. As economies expand and populations grow, the need for reliable electricity supply continues to escalate. Projections indicate that global electricity demand will increase by approximately 25% by 2030, necessitating significant investments in transmission and distribution infrastructure. This surge in demand compels utilities to enhance their systems to ensure they can meet consumer needs without compromising reliability. The Transmission Distribution Infrastructure Market must therefore focus on expanding capacity, upgrading aging infrastructure, and implementing innovative solutions to manage this growing demand effectively. Addressing these challenges is critical for sustaining economic growth and improving quality of life.

Focus on Infrastructure Resilience

The focus on infrastructure resilience is increasingly shaping the Transmission Distribution Infrastructure Market. As extreme weather events become more frequent, the need for robust and adaptable infrastructure is paramount. Investments in resilient transmission systems are projected to rise significantly, with estimates suggesting a growth of over 20% in the next five years. This trend reflects a broader recognition of the vulnerabilities within existing infrastructure and the necessity for upgrades that can withstand environmental challenges. Enhanced resilience not only protects assets but also ensures continuous service delivery during adverse conditions. The Transmission Distribution Infrastructure Market must prioritize resilience to safeguard against disruptions and maintain public trust in energy systems.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in driving the Transmission Distribution Infrastructure Market. Various governments are implementing policies aimed at modernizing energy infrastructure, with substantial financial backing. In 2025, it is anticipated that public funding for transmission projects will reach unprecedented levels, potentially exceeding 50 billion dollars. These initiatives often focus on enhancing grid reliability, integrating renewable energy, and improving energy efficiency. By providing financial incentives and regulatory support, governments are encouraging private sector participation in infrastructure development. This collaborative approach is essential for addressing the growing demand for electricity and ensuring that the Transmission Distribution Infrastructure Market evolves in line with technological advancements and consumer expectations.

Adoption of Smart Grid Technologies

The adoption of smart grid technologies is transforming the Transmission Distribution Infrastructure Market. Smart grids enhance the efficiency and reliability of electricity distribution through advanced monitoring and control systems. By 2025, it is projected that smart grid investments will exceed 100 billion dollars, driven by the need for improved energy management and reduced operational costs. These technologies enable real-time data collection and analysis, allowing utilities to optimize energy distribution and respond swiftly to outages. Furthermore, smart grids facilitate consumer engagement by providing detailed usage data, which can lead to more informed energy consumption decisions. The ongoing evolution of the Transmission Distribution Infrastructure Market is closely tied to the successful implementation of these innovative technologies.

Integration of Renewable Energy Sources

The increasing integration of renewable energy sources into the Transmission Distribution Infrastructure Market is a pivotal driver. As nations strive to meet sustainability goals, the demand for infrastructure that can accommodate solar, wind, and other renewable sources is surging. In 2025, it is estimated that renewable energy will account for over 30% of total electricity generation, necessitating upgrades to existing transmission systems. This shift not only enhances energy security but also reduces reliance on fossil fuels, thereby promoting environmental sustainability. The Transmission Distribution Infrastructure Market must adapt to these changes by investing in technologies that facilitate the seamless integration of diverse energy sources, ensuring reliability and efficiency in energy delivery.