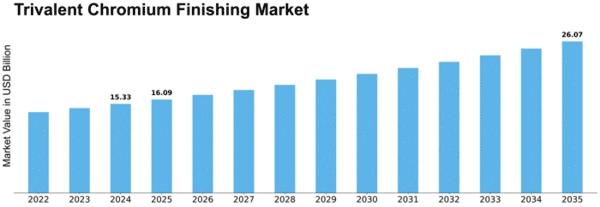

Trivalent Chromium Finishing Size

Trivalent Chromium Finishing Market Growth Projections and Opportunities

The global trivalent chromium finishing market is poised to exhibit a robust Compound Annual Growth Rate (CAGR) of 5.80% during the forecast period spanning from 2018 to 2025. By the end of 2025, the market is anticipated to achieve a substantial value of USD 415,058.29 thousand. This growth trajectory is primarily steered by pivotal factors such as stringent regulations governing the use of hexavalent chromium and the escalating demand for trivalent chromium plating within the automotive industry. Additionally, the anticipated surge in the adoption of chrome-plateable plastics across diverse applications is expected to further propel the market during the forecast period.

A significant driver for the increasing adoption of trivalent chromium finishing is the stringent regulatory landscape surrounding hexavalent chromium. Regulatory bodies worldwide, recognizing the adverse health and environmental impacts associated with hexavalent chromium, have imposed strict regulations on its usage. In response, industries are increasingly turning to trivalent chromium finishing as a more environmentally friendly and compliant alternative. This shift aligns with global efforts to reduce the ecological footprint of manufacturing processes and underscores the market's responsiveness to evolving regulatory standards.

The automotive industry plays a pivotal role in propelling the demand for trivalent chromium finishing. The sector's stringent weight reduction objectives, driven by the need to curb CO2 emissions and enhance fuel efficiency, have prompted the widespread adoption of trivalent chromium plating. Chrome-plated plastics, featuring trivalent chromium finishing, are especially gaining traction in automotive applications. These materials, with their advantageous properties, contribute not only to weight reduction but also to enhanced aesthetics and durability in automotive components.

Moreover, the forecasted high growth in the use of chrome-plateable plastics across diverse applications is expected to be a significant driver for the overall market growth. As industries increasingly recognize the versatility and advantages of chrome-plated plastics, the demand for trivalent chromium finishing is set to surge across various sectors beyond automotive, including electronics, packaging, and household products. The ability of trivalent chromium to confer desirable physical properties to plastics, such as luster, abrasion resistance, and weatherproofing flexibility, positions it as a sought-after solution in diverse applications.

However, the market faces challenges that could potentially impede its growth trajectory. The emergence of thermal spray coating as an effective alternative to hard chrome plating is identified as a key factor that may hinder the growth of the trivalent chromium finishing market in the coming years. Thermal spray coating offers a viable alternative, particularly in applications where durability and wear resistance are critical factors. As industries explore alternative coating technologies, the market for trivalent chromium finishing may experience competition from these emerging solutions.

Furthermore, the high costs associated with trivalent chromium finishing could pose a significant challenge for market growth. While the benefits of trivalent chromium in terms of compliance and environmental friendliness are evident, the economic considerations may impact its adoption, especially in cost-sensitive industries.

The segmentation of the global trivalent chromium finishing market is structured based on type, application, and region. This strategic segmentation allows for a comprehensive understanding of the market dynamics, catering to the varied needs and preferences across different sectors and geographic locations.

In conclusion, the global trivalent chromium finishing market is on a trajectory of substantial growth, driven by regulatory shifts away from hexavalent chromium and the increasing demand within the automotive industry. Despite challenges posed by emerging alternatives and cost considerations, the market is poised to capitalize on the anticipated surge in the adoption of chrome-plateable plastics across diverse applications. The segmentation of the market further enhances its adaptability to the unique requirements of different industries and regions, ensuring a nuanced and dynamic response to evolving market trends.

Leave a Comment