Truck Rental Size

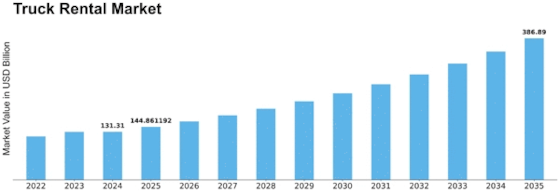

Truck Rental Market Growth Projections and Opportunities

The truck rental market is stimulated by a myriad of factors that collectively outline its panorama, impacting supply, demand, and standard competitiveness. Economic situations stand out as a primary determinant, as the marketplace intently follows the cyclical nature of commercial enterprise sports. During durations of financial increase, groups increase their operations, triggering an uptick in demand for truck rentals to satisfy heightened transportation desires. Conversely, monetary downturns may additionally lead to a contraction in demand as corporations cut back operations, affecting the utilization costs of condo fleets. The aggressive landscape is an important market component, with each country-wide and nearby gamers vying for marketplace percentage. Fierce competition frequently results in pricing wars as agencies attempt to draw clients through aggressive quotes and price-added offerings. Fleet length, geographic insurance, and carrier pleasant grow to be key differentiators in this intensely contested market. Strategic choices made by the most important gamers can substantially impact normal marketplace trends and dynamics. Regulatory issues upload complexity to the truck rental marketplace. Compliance with safety standards, environmental guidelines, and licensing necessities is a consistent situation for condo companies. Changes in guidelines, whether or not related to emission standards or safety protocols, can affect operational costs and have an impact on the composition of condominium fleets. Staying knowledgeable about and adapting to regulatory trends are vital for groups operating in this area. Technological improvements are reshaping the marketplace by enhancing operational performance and customer enjoyment. The integration of telematics, GPS tracking, and digital platforms enables advanced fleet management, preventive maintenance, and real-time monitoring. Rental companies embracing that technology benefits a competitive side, providing customers with streamlined tactics and more suitable visibility into their leases. The availability and value of gas are essential marketplace factors affecting operational charges for truck rental corporations. Fluctuations in gas expenses directly impact the general price of running a rental fleet. Companies regularly hire techniques, including incorporating gasoline-efficient motors, optimizing transportation routes, and imposing fuel surcharges to mitigate the effect of unstable gasoline prices on their bottom line. Global economic factors, including change dynamics and geopolitical events, also exert an impact on the truck rental market. Changes in change policies, tariffs, and geopolitical tensions can disrupt the movement of products, impacting demand for transportation services. Rental organizations with an international footprint have to navigate those external factors to assume shifts in demand and adjust their operations for this reason. In the end, the truck rental market is formed by a complex interaction of financial, seasonal, aggressive, regulatory, technological, and client-associated elements. Successfully navigating these factors requires adaptability, strategic making plans, and an eager expertise of the dynamic forces at play in the transportation and logistics enterprise.

Leave a Comment