Growth in the Food and Beverage Sector

The Tube Laminating Film Market is significantly influenced by the expansion of the food and beverage sector. As this industry continues to grow, the demand for packaging solutions that ensure product freshness and safety is paramount. Laminating films are increasingly utilized for their ability to provide excellent moisture and oxygen barriers, which are essential for preserving food quality. Recent market analysis suggests that the food packaging segment is expected to account for over 40% of the total demand for laminating films in the coming years. This trend indicates a robust opportunity for manufacturers within the Tube Laminating Film Market to cater to the specific needs of food and beverage companies, thereby driving further growth and innovation.

Rising Demand for Eco-Friendly Packaging

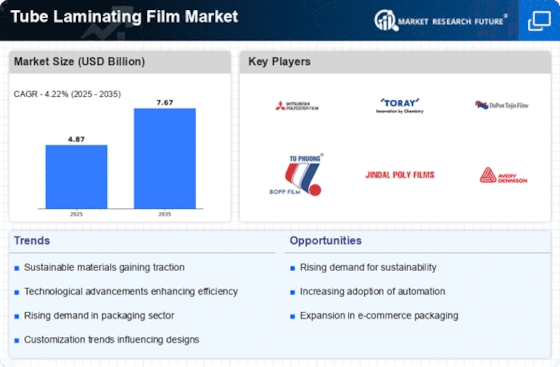

The Tube Laminating Film Market is experiencing a notable shift towards eco-friendly packaging solutions. As consumers become increasingly aware of environmental issues, there is a growing preference for sustainable materials. This trend is reflected in the rising demand for laminating films that are recyclable and made from biodegradable materials. According to recent data, the market for sustainable packaging is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years. This shift not only aligns with consumer preferences but also encourages manufacturers to innovate and develop new products that meet these sustainability criteria. Consequently, the Tube Laminating Film Market is likely to see an influx of products that cater to this demand, potentially reshaping the competitive landscape.

Regulatory Compliance and Safety Standards

The Tube Laminating Film Market is also shaped by stringent regulatory compliance and safety standards. As governments and regulatory bodies impose stricter guidelines on packaging materials, manufacturers are compelled to adapt their products to meet these requirements. This includes ensuring that laminating films are free from harmful substances and are safe for food contact. Compliance with these regulations not only enhances consumer trust but also opens up new market opportunities. Recent data indicates that adherence to safety standards can increase market competitiveness, as products that meet these criteria are more likely to be favored by consumers and retailers alike. Thus, the Tube Laminating Film Market is likely to see a rise in demand for compliant products, driving innovation and quality improvements.

Technological Innovations in Film Production

Technological advancements play a crucial role in the Tube Laminating Film Market, driving efficiency and product quality. Innovations in production techniques, such as the use of advanced extrusion processes and high-performance polymers, have led to the development of films that offer superior barrier properties and durability. These enhancements not only improve the functionality of the films but also reduce production costs, making them more accessible to a wider range of applications. Recent studies indicate that the adoption of these technologies could increase production efficiency by up to 20%, thereby expanding the market reach. As manufacturers continue to invest in research and development, the Tube Laminating Film Market is poised for significant growth, with new products entering the market that meet evolving consumer needs.

Increasing Applications in Personal Care Products

The Tube Laminating Film Market is witnessing a surge in applications within the personal care sector. As consumer preferences shift towards high-quality packaging that enhances product appeal, manufacturers are increasingly turning to laminating films for their aesthetic and functional benefits. These films not only provide a visually appealing finish but also protect products from external contaminants. The personal care market is projected to grow at a rate of approximately 5% annually, which bodes well for the Tube Laminating Film Market. This growth presents opportunities for companies to develop specialized films tailored to the unique requirements of personal care products, thereby expanding their market presence and driving innovation.