Market Trends

Key Emerging Trends in the Tungsten Carbide Market

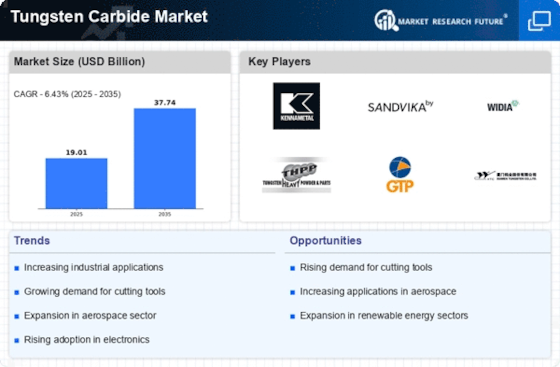

There are notable trends taking place within the Tungsten Carbide market which are shaping its landscape as well as influencing key aspects within this industry.” Such changes reflect shifting demands from various sectors and how well they are accommodated by this material.

The increasing production in the oil and gas sector provides rich opportunities for the tungsten carbide market. It is highly malleable because of its hardiness which makes it possible to mold it into different shapes and sizes for wide range of uses.

One of the top trends that are influencing Tungsten Carbide market is the rising demand from industrial applications. For manufacturing, mining, and oil industries Tungsten Carbide has extreme hardness and wear resistance hence preferred. This led to increased demand for tools and equipment with tungsten carbide components due to their resilience in industries that have harsh conditions.

Also, the automotive industry continues playing a major role towards shaping the Tungsten Carbide market. It has been widely used on cutting tools, wear parts as well as engine components making it very useful. As a result there has been an increase in demand for materials such as tungsten carbide which can endure tough conditions while producing light weight vehicles characterized by fuel efficiency.

There has also been an upsurge in mining activities leading to increased demand for Tungsten Carbide. Its sturdiness makes it indispensable in mining operations such as drill bits, cutting tools, among other wear-resistant components. This is one of the primary drivers responsible for growth of this industry since mineral and metal demands have been on the rise globally during this period.

The advancement of technology resulted in innovations of new products using these materials that possessed better properties than before. The use of nanotechnology and improvement in manufacturing processes has expanded its use across various industries (Johnson). This highlights the importance of innovation as a critical factor in driving future growth within this marketplace.

Environmental concerns are also impacting the Tungsten Carbide market. Sustainable development goals call for durable products which reduce maintenance activities through long lasting goods thereby conserving raw materials like tungsten carbides with longer shelf lives than alternative options. More recently, industries have been seeking green products that have long lifespans and tungsten carbide has met the criteria, thereby positively affecting its market growth.

Leave a Comment