Growth of E-commerce in Health Products

The Two-Piece Empty Hard Capsule Market is experiencing a boost from the growth of e-commerce in health products. As online shopping becomes increasingly prevalent, consumers are turning to digital platforms for their health and wellness needs. This trend is particularly pronounced in the dietary supplement sector, where convenience and accessibility are paramount. Recent data indicates that e-commerce sales of health products are projected to grow at a CAGR of approximately 10% over the next few years. This shift towards online purchasing is likely to drive demand for Two-Piece Empty Hard Capsules, as manufacturers and retailers adapt to the changing landscape by offering a wider range of encapsulated products online. Consequently, the Two-Piece Empty Hard Capsule Market stands to benefit from this evolving retail environment.

Expansion of Pharmaceutical Applications

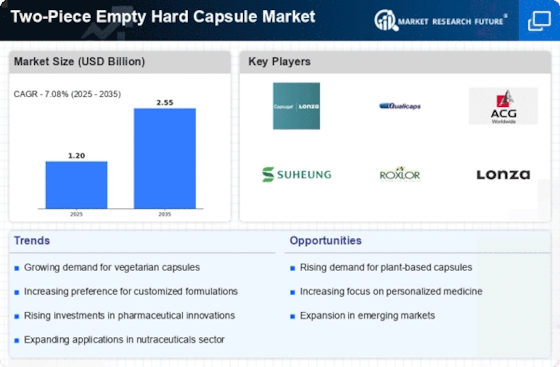

The Two-Piece Empty Hard Capsule Market is significantly benefiting from the expansion of pharmaceutical applications. As the pharmaceutical sector continues to innovate, there is an increasing need for effective drug delivery systems. Capsules are favored for their ability to mask unpleasant tastes and odors, which is particularly advantageous for certain medications. Recent statistics indicate that the pharmaceutical industry is expected to grow at a compound annual growth rate (CAGR) of around 5% over the next few years. This growth is likely to drive the demand for Two-Piece Empty Hard Capsules, as pharmaceutical companies seek reliable and efficient means to deliver their products. Additionally, the versatility of capsules in accommodating various formulations, including powders and liquids, further enhances their appeal within the pharmaceutical sector.

Increasing Demand for Dietary Supplements

The Two-Piece Empty Hard Capsule Market is experiencing a notable surge in demand for dietary supplements. This trend is largely driven by a growing awareness of health and wellness among consumers. As individuals increasingly seek preventive healthcare solutions, the consumption of vitamins, minerals, and herbal supplements has risen. According to recent data, the dietary supplement market is projected to reach a valuation of approximately 300 billion USD by 2025. This growth directly influences the Two-Piece Empty Hard Capsule Market, as manufacturers are compelled to produce more capsules to meet the rising demand for encapsulated supplements. Furthermore, the convenience and ease of consumption offered by capsules make them a preferred choice for consumers, thereby enhancing the market's growth potential.

Technological Innovations in Capsule Production

The Two-Piece Empty Hard Capsule Market is being transformed by technological innovations in capsule production. Advances in manufacturing processes, such as the use of automated systems and improved quality control measures, are enhancing production efficiency and product quality. These innovations allow for the creation of capsules that are not only more consistent in size and shape but also more effective in preserving the integrity of the contents. Recent developments indicate that the market for capsule manufacturing technology is expected to grow significantly, with projections suggesting a CAGR of around 6% in the coming years. This technological progress is likely to bolster the Two-Piece Empty Hard Capsule Market, as manufacturers strive to meet the increasing demands for high-quality encapsulated products.

Rising Popularity of Vegan and Vegetarian Products

The Two-Piece Empty Hard Capsule Market is witnessing a shift towards vegan and vegetarian products, reflecting broader consumer trends. As more individuals adopt plant-based diets, the demand for vegetarian capsules is on the rise. This shift is not merely a fad; it appears to be a long-term change in consumer preferences. Market Research Future suggests that the vegetarian capsule segment is expected to grow at a CAGR of approximately 8% over the next five years. This growth is indicative of a larger movement towards sustainable and ethical consumption. Consequently, manufacturers within the Two-Piece Empty Hard Capsule Market are increasingly investing in the development of plant-based capsules to cater to this evolving consumer base, thereby enhancing their market position.

Leave a Comment