Rising Urbanization

The Global Two-wheeler Aftermarket Industry experiences a notable boost due to increasing urbanization. As more individuals migrate to urban areas, the demand for efficient and cost-effective transportation solutions rises. Two-wheelers, being more affordable and easier to navigate through congested city streets, become a preferred choice. This trend is particularly evident in developing regions, where urban populations are projected to grow significantly. The Global Two-wheeler Aftermarket Industry is likely to benefit from this shift, as urban dwellers seek aftermarket parts and services to maintain their vehicles, contributing to an anticipated market value of 46.5 USD Billion in 2024.

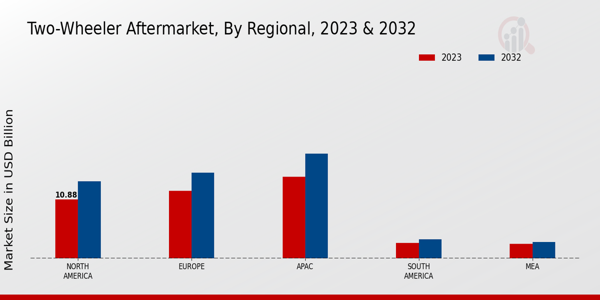

Market Growth Projections

The Global Two-wheeler Aftermarket Industry is projected to experience substantial growth over the coming years. With an estimated market value of 46.5 USD Billion in 2024, the industry is expected to expand to 63.7 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 2.91% from 2025 to 2035. Such projections reflect the increasing demand for two-wheelers and the corresponding need for aftermarket products and services. As the market evolves, stakeholders are likely to explore new opportunities, ensuring that the Global Two-wheeler Aftermarket Industry remains dynamic and responsive to consumer needs.

Technological Advancements

Technological advancements play a crucial role in shaping the Global Two-wheeler Aftermarket Industry. Innovations in vehicle design, materials, and manufacturing processes lead to the development of more sophisticated two-wheelers. As these vehicles become increasingly complex, the need for specialized aftermarket parts and services grows. For instance, the integration of smart technology in two-wheelers necessitates compatible aftermarket components, thereby expanding the market. The Global Two-wheeler Aftermarket Industry is poised to capitalize on these advancements, as consumers seek to upgrade and maintain their technologically advanced vehicles, contributing to a projected CAGR of 2.91% from 2025 to 2035.

Increasing Disposable Income

The Global Two-wheeler Aftermarket Industry benefits from rising disposable incomes, particularly in emerging economies. As individuals experience an increase in their financial capacity, they are more likely to invest in personal transportation. This trend is evident in regions where economic growth is robust, leading to higher sales of two-wheelers. Consequently, the demand for aftermarket products and services also rises, as consumers seek to personalize and maintain their vehicles. The Global Two-wheeler Aftermarket Industry is expected to see substantial growth, driven by this increase in disposable income, further solidifying its position in the global market.

Growing Demand for Fuel Efficiency

The Global Two-wheeler Aftermarket Industry is significantly influenced by the increasing consumer preference for fuel-efficient vehicles. As fuel prices fluctuate, riders are more inclined to invest in two-wheelers that offer better mileage. This trend drives the demand for aftermarket modifications and enhancements aimed at improving fuel efficiency. Manufacturers and service providers within the Global Two-wheeler Aftermarket Industry are responding by offering a range of products, from performance-enhancing parts to eco-friendly lubricants. This focus on fuel efficiency is expected to sustain the market's growth trajectory, with projections indicating a market size of 63.7 USD Billion by 2035.

Environmental Concerns and Regulations

The Global Two-wheeler Aftermarket Industry is increasingly shaped by environmental concerns and regulatory measures aimed at reducing emissions. Governments worldwide are implementing stricter emissions standards, prompting manufacturers and consumers to seek greener alternatives. This shift creates opportunities within the aftermarket sector, as companies develop eco-friendly parts and services. For instance, the demand for electric two-wheelers is on the rise, leading to a corresponding need for specialized aftermarket components. As environmental awareness continues to grow, the Global Two-wheeler Aftermarket Industry is likely to adapt, ensuring compliance with regulations while meeting consumer preferences for sustainable transportation.