Type 2 Diabetes Mellitus Treatment Size

Market Size Snapshot

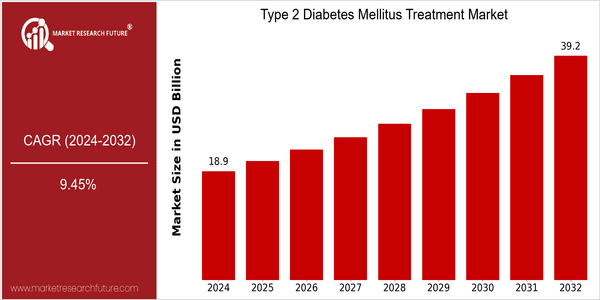

| Year | Value |

|---|---|

| 2024 | USD 18.86 Billion |

| 2032 | USD 39.18 Billion |

| CAGR (2024-2032) | 9.45 % |

Note – Market size depicts the revenue generated over the financial year

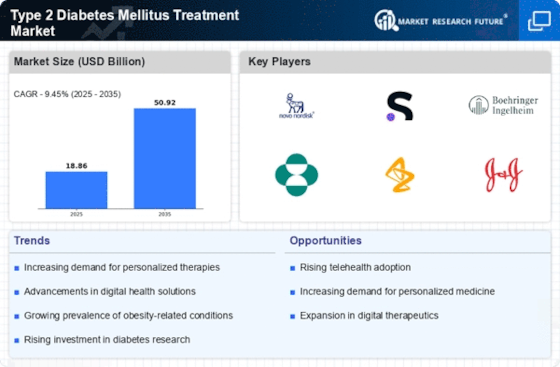

The Type 2 diabetes treatment market is estimated to reach $39.18 billion by 2032. This represents a CAGR of 9.46% during the forecast period. The main reason for this increase is the increasing prevalence of Type 2 diabetes. This increase is primarily driven by the rise in obesity, sedentary lifestyles, and the aging population. The development of new drugs and digital health solutions are also driving market growth. The leading companies, such as Novo Nordisk, Sanofi, and Eli Lilly, are investing heavily in R&D to improve their products. Strategic initiatives are increasingly common, such as collaborations and partnerships aimed at integrating diabetes management and technology. Glucose monitoring systems and mobile health applications are changing the way diabetes is treated and patients adhere to their treatment regimens. These trends are expected to play a key role in shaping the future of the Type 2 diabetes treatment market.

Regional Market Size

Regional Deep Dive

The treatment of diabetes mellitus is undergoing considerable growth in all regions, owing to the increase in the prevalence of diabetes, the advancement of treatment and the heightened awareness of diabetes. North America, where there is a high uptake of new drugs and a strong health care system, is characterized by the rapid acceptance of new drugs and the strong regulatory environment. Europe is characterized by a high level of prevention and stricter regulations. The Asia-Pacific region is experiencing rapid growth due to the increase in urbanization and lifestyle changes, while the Middle East and Africa are faced with special challenges due to the low level of access to health care and the disparity in economic development. Latin America is also a major player in the field of diabetes mellitus, with increasing investments in health care and a growing middle class with an increased health consciousness.

Europe

- The European Medicines Agency (EMA) has introduced streamlined approval processes for diabetes medications, encouraging innovation and faster access to new treatments for patients.

- Countries like Germany and the UK are implementing national diabetes prevention programs that focus on lifestyle interventions, which are expected to reduce the incidence of Type 2 diabetes and subsequently impact treatment demand.

Asia Pacific

- China is witnessing a surge in Type 2 diabetes cases, prompting the government to launch initiatives aimed at increasing public awareness and improving access to diabetes care and treatment.

- Innovative digital health solutions, such as mobile apps for diabetes management, are gaining popularity in countries like India and Australia, enhancing patient engagement and adherence to treatment regimens.

Latin America

- Brazil has launched a national diabetes control program that aims to improve screening and treatment access, which is expected to significantly impact the management of Type 2 diabetes in the region.

- Pharmaceutical companies are increasingly investing in local production facilities in Latin America, which is anticipated to lower drug prices and improve availability of diabetes treatments.

North America

- The U.S. Food and Drug Administration (FDA) has recently approved several new medications for Type 2 diabetes, including novel GLP-1 receptor agonists, which are expected to enhance treatment options and improve patient outcomes.

- Telehealth services have gained traction in the U.S. and Canada, allowing for better management of diabetes through remote monitoring and consultations, which is particularly beneficial for patients in rural areas.

Middle East And Africa

- The World Health Organization (WHO) has initiated programs in several African countries to improve diabetes care, focusing on education and access to essential medications.

- In the Gulf Cooperation Council (GCC) countries, there is a growing emphasis on lifestyle modification programs, supported by local governments, to combat the rising prevalence of Type 2 diabetes.

Did You Know?

“Approximately 90-95% of all diabetes cases are Type 2, and the condition is often preventable through lifestyle changes such as diet and exercise.” — Centers for Disease Control and Prevention (CDC)

Segmental Market Size

The Type 2 diabetes treatment market is characterized by the growing segment of new therapeutic solutions, including oral medicines, injections, and lifestyle management. This segment is growing due to the growing prevalence of diabetes, increasing awareness of the disease, and the development of treatment solutions. The growing prevalence of obesity, which is closely related to Type 2 diabetes, and the growing demand for individualized treatment are the main drivers. The exploitation phase of this segment is currently in a period of maturity, with companies such as Novo Nordisk and Eli Lilly leading in the development of new medicines and the introduction of patient management solutions. The most important new medicines are the GLP-1 agonists and the SGLT2 blockers, which have become well established in the clinical environment. The main patient management solutions are medication adherence, telemedicine, and integrated diabetes management. The growth of the market is also driven by a greater focus on prevention and by government initiatives to increase diabetes awareness. The technological development of the segment is influenced by the development of continuous blood sugar monitoring systems and mobile health applications, which increase the patient's involvement in treatment and improve treatment outcomes.

Future Outlook

The type 2 diabetes treatment market is set to grow at a CAGR of 9.46% from 2024 to 2032. This growth will be driven by the rising prevalence of type 2 diabetes, a result of increasing obesity rates, sedentary lifestyles, and an aging population. The market will be characterized by a high penetration of diabetes treatments. Compared to 2024, penetration is expected to increase from around 30% to around 50% by 2032. This will be attributed to a higher acceptance of pharmacological and non-pharmacological interventions among patients and health care professionals. In addition, several technological developments, such as the development of novel oral medications, continuous glucose monitoring systems, and digital health solutions, will reshape the treatment landscape. And supportive policy frameworks, which aim to improve access to and affordability of diabetes care, will also boost growth. The integration of artificial intelligence into diabetes treatment regimens and the development of individualized therapies are expected to improve patient outcomes and adherence to treatment. Against this backdrop, companies will have to stay agile to capitalize on these trends and meet the rising demand for effective and novel diabetes treatments.

Leave a Comment