Market Trends

Introduction

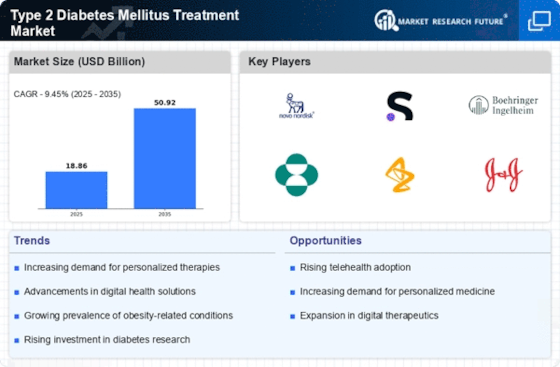

In 2024, the world market for the treatment of type 2 diabetes mellitus is experiencing significant changes, a confluence of macroeconomic factors. Technological advances in diabetes management, including the emergence of eHealth and the emergence of continuous blood-glucose monitoring, are reshaping treatment paradigms and increasing patient engagement. Regulation is also stepping up, with health authorities demanding new therapies with improved efficacy and safety profiles. In addition, changing consumer preferences, including a greater preference for a more individualized and more natural approach to health, are influencing treatment choices and market dynamics. These trends are of strategic importance for market players, as they shape not only competitive positioning but also investment strategies and product development in a rapidly evolving landscape.

Top Trends

-

Increased Focus on Personalized Medicine

In recent years, a new trend has been developing in the field of medicine: a tendency towards more individual treatment, with companies such as Eli Lilly and Novo Nordisk investing in the use of genetic material to make treatments more effective. A study has shown that a more individual approach can increase patient adherence by 30 per cent. This development is expected to lead to a reduction in the cost of treatment and increased effectiveness. Other companies are expected to follow suit. -

Integration of Digital Health Solutions

IT solutions, such as mobile health and telemedicine, are increasingly being used in diabetes management. For example, the continuous glucose monitor developed by Abbott Laboratories is connected to a smartphone. The digital tools can lead to a 20 percent improvement in glycemic control, which is why more and more physicians are integrating these tools into their care plans. -

Emergence of Novel Therapeutics

The emergence of new therapeutics, such as GLP-1 agonists and SGLT-2 blockers, has changed the face of the treatment. With the new approvals, the AstraZeneca and Merck companies are at the forefront of the industry. These drugs have been shown in clinical trials to reduce the risk of heart attack by up to 15 percent, which has led to a change in the way of prescribing and a sharp increase in competition. -

Government Initiatives for Diabetes Management

The war against diabetes is being fought by many governments, including the United States, where the National Diabetes Prevention Program is a great success. The aim of these programmes is to reduce the incidence of diabetes by 25% in ten years. Such initiatives are stimulating the pharmaceutical industry to undertake research and development to meet public health needs. -

Focus on Preventive Care

In the past few years, preventive care has been the focus of many organizations, which have advocated early intervention to control risk factors. Data show that lifestyle changes can reduce the risk of type 2 diabetes by 58%. In view of this, the pharmaceutical industry has begun to seek collaboration with the health industry, which can not only broaden its market, but also improve the patient’s outcome. -

Advancements in Insulin Delivery Systems

Insulin injection devices such as smart pens and automatic injection systems are changing diabetes care. Companies like Becton, Dickinson and Company are at the forefront of this change, with devices that improve the accuracy of insulin dosing. These devices can increase patient adherence by up to 40 percent, and studies have shown that this means a more stable market for insulin products. -

Increased Collaboration Between Pharma and Tech

The cooperation between the pharmaceutical and the technical industries is growing rapidly. The goal is to improve the diabetes management solutions. Roche and a number of technology companies, for example, are developing artificial intelligence-based analysis tools for improved patient monitoring. The trend is expected to lead to a better process and patient engagement, which will lead to a change in the competitive environment. -

Rising Demand for Biosimilars

The demand for biosimilars is increasing as health systems look for cost-effective alternatives to expensive biologicals. Biosimilars have been shown to reduce treatment costs by up to 30 per cent. Biosimilars have a role to play in enabling a country’s health care system to be self-reliant and independent. This trend is likely to accelerate the market’s dynamic and encourage more players to enter the biosimilars market. -

Emphasis on Patient-Centric Approaches

The emphases of the future will be patient-centric, focusing on the overall patient experience. Sanofi, for example, is already putting in place a feedback system to adjust its treatments to patients’ needs. Research has shown that a satisfaction level of 92 per cent can lead to a compliance rate of 94 per cent, which has prompted a shift in the way companies design and market their products. -

Sustainability in Diabetes Care

SUITABLE PACKAGING AND PRODUCTION METHODS ARE BEING IMPLEMENTED IN THE WORLD OF DIABETES. For example, Takeda is investing in sustainable practices to reduce its carbon footprint. This trend is likely to influence the buying behaviour of consumers who are concerned about the environment.

Conclusion: Navigating the Type 2 Diabetes Landscape

The market for the treatment of type 2 diabetes is characterised by intense competition and considerable fragmentation, with both established and new players competing for market share. In terms of regional trends, a greater focus on individualised treatment is developing, particularly in North America and Europe, where health systems are increasingly introducing new solutions. Strategically, vendors need to take advantage of new technological possibilities such as artificial intelligence for predictive analytics, automation for process efficiency, and sustainability practices to meet evolving consumer expectations. In addition, they must be able to respond to changing market needs quickly. These are the areas in which decision-makers need to concentrate in order to establish themselves as market leaders and to ensure long-term success in this complex market.

Leave a Comment