Increased Energy Demand

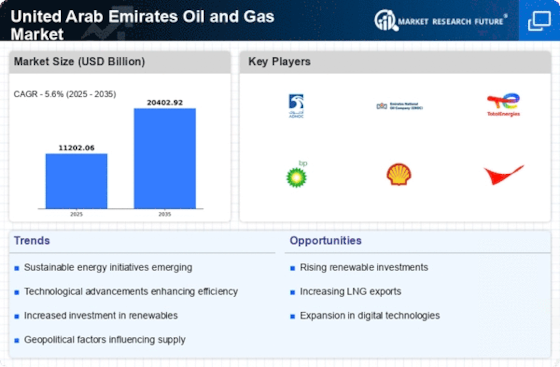

The United Arab Emirates Oil and Gas Market is currently experiencing a surge in energy demand, driven by population growth and urbanization. As the UAE continues to develop its infrastructure and diversify its economy, the need for energy resources is expected to rise. In 2025, the UAE's energy consumption is projected to increase by approximately 3.5% annually, necessitating a robust supply of oil and gas. This demand is further fueled by the country's commitment to becoming a regional energy hub, which may lead to increased investments in exploration and production activities. Consequently, the United Arab Emirates Oil and Gas Market is likely to see enhanced operational capacities to meet this growing demand.

Technological Advancements

Technological innovations are playing a pivotal role in shaping the United Arab Emirates Oil and Gas Market. The adoption of advanced technologies such as artificial intelligence, big data analytics, and automation is enhancing operational efficiency and reducing costs. In 2025, it is estimated that the implementation of these technologies could lead to a 20% increase in production efficiency across the sector. Moreover, the integration of digital solutions is facilitating better decision-making processes and optimizing resource management. As the industry embraces these advancements, the United Arab Emirates Oil and Gas Market is likely to become more competitive and resilient in the face of fluctuating market conditions.

Regulatory Framework and Policy Support

The regulatory framework and policy support provided by the UAE government are crucial for the growth of the United Arab Emirates Oil and Gas Market. The government has implemented various initiatives aimed at attracting investments and ensuring sustainable practices within the sector. In 2025, the introduction of new policies focused on environmental sustainability and energy efficiency is expected to reshape operational practices. These regulations may encourage companies to adopt cleaner technologies and reduce their carbon footprint, aligning with global sustainability goals. Consequently, the United Arab Emirates Oil and Gas Market is likely to evolve in response to these regulatory changes, fostering a more sustainable energy future.

Emerging Markets and Export Opportunities

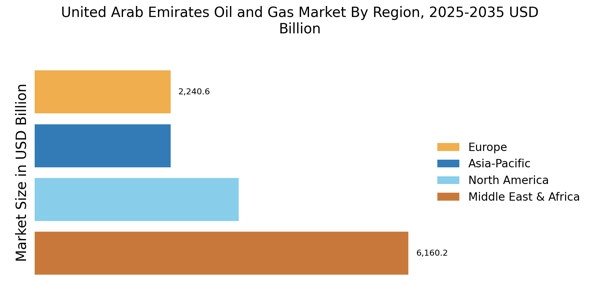

Emerging markets present significant export opportunities for the United Arab Emirates Oil and Gas Market. As countries in Asia and Africa continue to industrialize, their demand for oil and gas is expected to rise substantially. In 2025, it is projected that the UAE will increase its exports to these regions, potentially capturing a larger share of the market. This trend may be supported by the UAE's strategic geographical location, which facilitates access to key markets. Additionally, the diversification of the UAE's export portfolio could enhance its resilience against market volatility. Therefore, the United Arab Emirates Oil and Gas Market is likely to capitalize on these emerging opportunities to strengthen its global presence.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are emerging as a key driver in the United Arab Emirates Oil and Gas Market. The UAE government actively encourages foreign investments and joint ventures, which can enhance technological transfer and expertise. In 2025, the number of international partnerships in the oil and gas sector is expected to increase, potentially leading to a more diversified portfolio of projects. These collaborations may also facilitate access to new markets and resources, thereby strengthening the UAE's position in the global energy landscape. As a result, the United Arab Emirates Oil and Gas Market is likely to benefit from enhanced innovation and competitiveness.