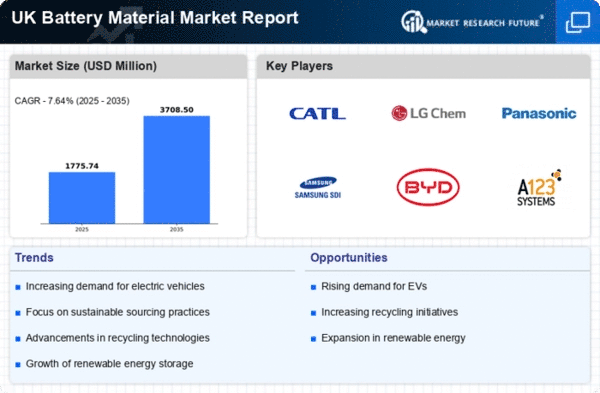

The battery material market is currently characterized by intense competition and rapid innovation, driven by the increasing demand for electric vehicles (EVs) and renewable energy storage solutions. Key players such as Contemporary Amperex Technology Co. Limited (CN), LG Chem Ltd. (KR), and Northvolt AB (SE) are strategically positioning themselves through technological advancements and partnerships. These companies are focusing on enhancing battery performance and sustainability, which collectively shapes a competitive environment that is increasingly reliant on innovation and efficiency.

In terms of business tactics, companies are localizing manufacturing to reduce supply chain vulnerabilities and optimize logistics. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies is substantial, as they leverage economies of scale and advanced technologies to maintain competitive advantages. This dynamic fosters a landscape where smaller firms may struggle to keep pace with the rapid advancements and capital requirements of larger entities.

In October 2025, LG Chem Ltd. (KR) announced a significant investment in a new battery materials plant in the UK, aimed at increasing production capacity for high-performance lithium-ion batteries. This strategic move is likely to enhance LG Chem's position in the European market, allowing for better supply chain integration and responsiveness to local demand. The investment underscores the company's commitment to sustainability and innovation, aligning with the broader industry trend towards greener technologies.

In September 2025, Northvolt AB (SE) secured a partnership with a leading European automotive manufacturer to develop next-generation battery cells. This collaboration is expected to accelerate the development of sustainable battery solutions, reflecting Northvolt's focus on innovation and strategic alliances. Such partnerships are crucial in a market where technological advancements can rapidly shift competitive dynamics, enabling companies to share resources and expertise.

In August 2025, Samsung SDI Co. Ltd. (KR) unveiled a new battery recycling initiative aimed at recovering valuable materials from used batteries. This initiative not only addresses environmental concerns but also positions Samsung SDI as a leader in sustainable practices within the battery material sector. The strategic importance of this move lies in its potential to reduce raw material costs and enhance supply chain reliability, which is increasingly vital in a market facing resource constraints.

As of November 2025, current trends in the battery material market include a strong emphasis on digitalization, sustainability, and the integration of artificial intelligence (AI) in production processes. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to drive innovation and efficiency. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, supply chain reliability, and sustainable practices, reflecting the changing priorities of consumers and regulatory frameworks.