Increasing Healthcare Expenditure

The rise in healthcare expenditure in the UK is a significant driver for the biliary catheters market. With the National Health Service (NHS) and private healthcare providers investing more in advanced medical technologies, the availability of high-quality biliary catheters is improving. Recent reports indicate that healthcare spending in the UK has increased by approximately 5% annually, reflecting a commitment to enhancing patient care. This financial support enables hospitals and clinics to procure the latest biliary catheter technologies, which are essential for effective treatment of biliary disorders. Furthermore, as healthcare budgets expand, there is a greater emphasis on adopting innovative solutions that can improve patient outcomes, thereby fostering growth in the biliary catheters market.

Rising Incidence of Biliary Disorders

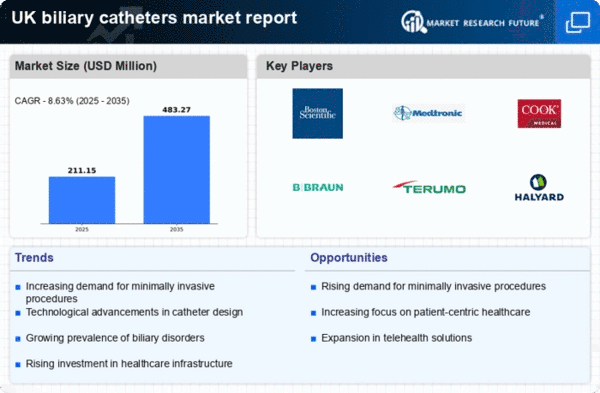

The increasing prevalence of biliary disorders in the UK is a primary driver for the biliary catheters market. Conditions such as cholangitis, biliary obstruction, and gallstones are becoming more common, leading to a higher demand for effective treatment options. According to recent health statistics, the incidence of these disorders has risen by approximately 15% over the past five years. This trend necessitates the use of biliary catheters for both diagnostic and therapeutic purposes, thereby propelling market growth. As healthcare providers seek to improve patient outcomes, the reliance on advanced biliary catheters is likely to increase, further stimulating the market. The growing awareness of these conditions among the population also contributes to the demand for biliary catheters, as patients are more proactive in seeking medical intervention.

Technological Innovations in Catheter Design

Innovations in catheter technology are significantly influencing the biliary catheters market. The introduction of advanced materials and designs has enhanced the functionality and safety of biliary catheters. For instance, the development of biocompatible materials reduces the risk of infection and improves patient comfort. Additionally, features such as radiopaque markers and hydrophilic coatings are becoming standard, allowing for better visualization and easier insertion. The market is witnessing a shift towards minimally invasive procedures, which are facilitated by these technological advancements. As a result, healthcare providers are increasingly adopting these innovative solutions, leading to a projected market growth of around 10% annually. This trend indicates a strong future for the biliary catheters market as technology continues to evolve.

Growing Demand for Minimally Invasive Procedures

The shift towards minimally invasive procedures is reshaping the biliary catheters market. Patients and healthcare providers alike are increasingly favouring techniques that reduce recovery time and minimize surgical risks. Biliary catheters play a crucial role in these procedures, allowing for effective drainage and intervention without the need for extensive surgery. This trend is supported by a growing body of evidence suggesting that minimally invasive approaches lead to better patient outcomes and shorter hospital stays. As a result, the market for biliary catheters is expected to expand, with an estimated growth rate of 8% over the next few years. The increasing acceptance of these techniques among surgeons and patients is likely to further drive the demand for biliary catheters.

Enhanced Focus on Patient Safety and Quality of Care

Emphasizing patient safety and quality of care is a critical driver for the biliary catheters market. Regulatory bodies and healthcare institutions in the UK are prioritizing the implementation of safety protocols and quality standards in medical procedures. This focus has led to the adoption of high-quality biliary catheters that meet stringent safety requirements. As healthcare providers strive to reduce complications associated with biliary interventions, the demand for reliable and effective catheters is increasing. Recent initiatives aimed at improving patient safety have resulted in a notable rise in the use of advanced biliary catheters, which are designed to minimize risks. Consequently, this heightened awareness and commitment to quality care are likely to propel the growth of the biliary catheters market.