Emergence of IoT and Smart Devices

The proliferation of Internet of Things (IoT) devices is significantly impacting the cloud managed-lan market. As more smart devices are integrated into business operations, the demand for efficient network management solutions increases. In the UK, it is estimated that the number of connected IoT devices will reach 1 billion by 2026, creating a pressing need for scalable and reliable network infrastructure. Cloud managed-lan solutions provide the necessary flexibility to accommodate the growing number of devices while ensuring optimal performance. This trend indicates a shift towards more intelligent networking solutions that can handle the complexities of IoT environments. As organizations seek to leverage IoT for operational efficiency, the is likely to see substantial growth driven by this technological advancement..

Increased Focus on Network Security

In the cloud managed-lan market, there is an increasing emphasis on network security as organizations face growing threats from cyberattacks. The UK has seen a rise in data breaches, prompting businesses to prioritize secure networking solutions. According to recent statistics, 60% of UK companies reported experiencing a cyber incident in the past year, highlighting the urgent need for robust security measures. Cloud managed-lan solutions offer advanced security features, such as encryption and real-time monitoring, which are essential for protecting sensitive data. This heightened focus on security is likely to drive investment in cloud managed-lan technologies, as organizations seek to safeguard their networks against evolving threats. Consequently, the cloud managed-lan market is positioned to benefit from this trend, as companies look for comprehensive solutions that integrate security with network management.

Growing Demand for Remote Work Solutions

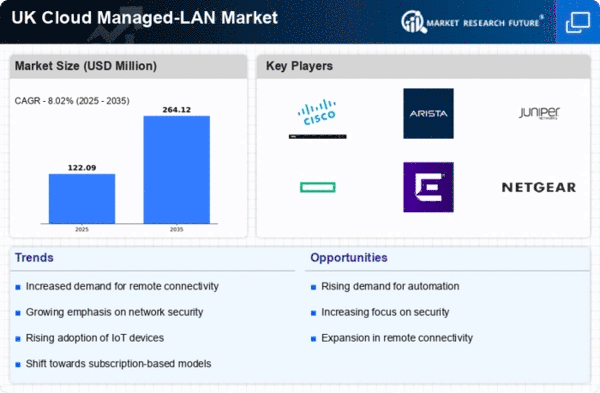

The cloud managed-lan market is experiencing a surge in demand for remote work solutions, driven by the need for flexible and efficient networking options. As businesses in the UK increasingly adopt hybrid work models, the requirement for reliable and scalable network infrastructure becomes paramount. This shift is reflected in the market data, which indicates that the cloud managed-lan market is projected to grow at a CAGR of 15% over the next five years. Companies are seeking solutions that enable seamless connectivity for remote employees while maintaining security and performance. The ability to manage networks from the cloud allows organizations to respond swiftly to changing demands, thereby enhancing operational efficiency. This trend underscores the importance of cloud managed-lan solutions in supporting the evolving work environment in the UK.

Regulatory Compliance and Data Governance

The cloud managed-lan market is increasingly influenced by the need for regulatory compliance and data governance. In the UK, businesses are required to adhere to stringent data protection regulations, such as the General Data Protection Regulation (GDPR). This regulatory landscape compels organizations to implement robust network management solutions that ensure compliance with data handling and privacy standards. Cloud managed-lan solutions offer features that facilitate compliance, such as data encryption and access controls, which are essential for safeguarding sensitive information. As companies navigate the complexities of regulatory requirements, the demand for cloud managed-lan technologies is expected to rise. This trend highlights the critical role of cloud managed-lan solutions in helping organizations maintain compliance while effectively managing their networks.

Cost Efficiency and Operational Flexibility

Cost efficiency remains a critical driver in the cloud managed-lan market, as organizations seek to optimize their IT expenditures. By leveraging cloud managed-lan solutions, businesses can reduce the costs associated with traditional networking infrastructure, such as hardware maintenance and upgrades. The UK market has shown that companies can save up to 30% on operational costs by transitioning to cloud-based networking solutions. This financial incentive, combined with the operational flexibility offered by cloud managed-lan technologies, makes them an attractive option for businesses looking to streamline their network management. The ability to scale resources according to demand further enhances cost-effectiveness, allowing organizations to allocate budgets more strategically. As a result, the cloud managed-lan market is likely to continue expanding as companies prioritize cost savings and flexibility in their networking strategies.