Growing Awareness of Hygiene Practices

The disposable hospital-supplies market benefits from a growing awareness of hygiene practices among healthcare professionals and patients alike. In the UK, there is an increasing emphasis on maintaining high levels of hygiene in medical settings, particularly in light of rising concerns about infection control. This heightened awareness encourages healthcare facilities to adopt disposable supplies, which are perceived as more hygienic compared to reusable alternatives. The market is witnessing a shift towards products that promote cleanliness and reduce the risk of infection transmission. Data indicates that the disposable hospital-supplies market is likely to expand as healthcare providers prioritize hygiene in their operational protocols. This trend reflects a broader societal shift towards health consciousness, further solidifying the role of disposable products in modern healthcare.

Regulatory Compliance and Safety Standards

The disposable hospital-supplies market is significantly influenced by stringent regulatory compliance and safety standards. In the UK, healthcare facilities must adhere to rigorous guidelines set forth by regulatory bodies to ensure patient safety and quality of care. These regulations often mandate the use of disposable supplies to prevent cross-contamination and reduce the risk of healthcare-associated infections. As a result, hospitals are increasingly investing in disposable products that meet these safety standards. The market is expected to see a rise in demand for certified disposable supplies, as compliance with regulations becomes a critical factor in procurement decisions. This focus on safety not only enhances patient outcomes but also drives the disposable hospital-supplies market forward, as healthcare providers prioritize products that align with regulatory requirements.

Rising Demand for Cost-Effective Solutions

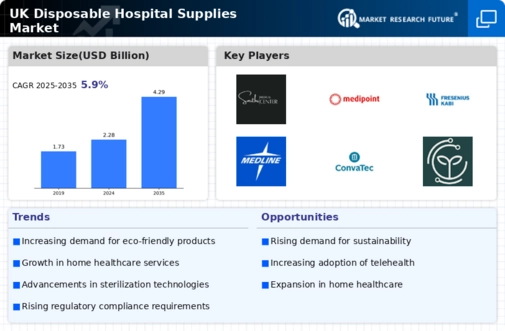

The disposable hospital-supplies market experiences a notable increase in demand for cost-effective solutions. Healthcare providers in the UK are under constant pressure to reduce operational costs while maintaining high standards of patient care. This trend drives hospitals and clinics to adopt disposable supplies, which often present a more economical alternative to reusable products. The disposable nature of these supplies minimizes the need for extensive cleaning and sterilization processes, thereby reducing labour costs. According to recent data, the disposable hospital-supplies market is projected to grow at a CAGR of approximately 6.5% over the next five years, reflecting the increasing preference for cost-efficient healthcare solutions. As financial constraints continue to challenge the healthcare sector, the shift towards disposable products is likely to persist, further propelling market growth.

Technological Innovations in Product Development

The disposable hospital-supplies market is experiencing a wave of technological innovations that enhance product development. Advances in materials science and manufacturing processes are leading to the creation of more efficient and effective disposable supplies. In the UK, manufacturers are investing in research and development to produce high-quality disposable products that meet the evolving needs of healthcare providers. Innovations such as biodegradable materials and improved barrier properties are becoming increasingly prevalent, appealing to environmentally conscious consumers. As these technologies continue to evolve, the disposable hospital-supplies market is likely to benefit from enhanced product offerings that cater to both performance and sustainability. This trend suggests a promising future for the market as it adapts to the demands of modern healthcare.

Increased Patient Volume and Healthcare Accessibility

this market is positively impacted by the increased patient volume and improved healthcare accessibility in the UK.. As the population ages and the prevalence of chronic diseases rises, healthcare facilities are experiencing a surge in patient numbers. This increase necessitates the use of disposable supplies to efficiently manage patient care without compromising quality. Furthermore, the expansion of healthcare services, including outpatient care and community health initiatives, drives the demand for disposable products. Hospitals and clinics are increasingly relying on disposable supplies to streamline operations and enhance patient throughput. Consequently, the disposable hospital-supplies market is poised for growth as healthcare providers adapt to the changing landscape of patient care and strive to meet the rising demand for services.