Government Incentives and Policies

The electric vehicle-charging-station market in the UK is significantly influenced by government incentives and policies aimed at promoting electric vehicle (EV) adoption. The UK government has committed to achieving net-zero emissions by 2050, which includes substantial investments in EV infrastructure. As of 2025, the government has allocated over £1.5 billion to support the installation of charging stations across the country. These initiatives not only enhance the availability of charging points but also encourage consumers to transition to electric vehicles. Furthermore, various grants and subsidies are available for businesses and local authorities to develop charging infrastructure, thereby stimulating growth in the electric vehicle-charging-station market. This supportive regulatory environment is likely to drive further investment and innovation in the sector.

Corporate Sustainability Initiatives

Many businesses in the UK are increasingly adopting corporate sustainability initiatives, which is positively impacting the electric vehicle-charging-station market. Companies are recognizing the importance of reducing their carbon footprint and are investing in electric vehicle infrastructure as part of their sustainability strategies. For instance, major corporations are installing charging stations at their facilities to support employees who drive electric vehicles. This trend is expected to grow, with estimates indicating that corporate investments in charging infrastructure could reach £500 million by 2027. Such initiatives not only enhance a company's public image but also contribute to the overall expansion of the electric vehicle-charging-station market, as more charging points become available in urban and suburban areas.

Urbanization and Infrastructure Development

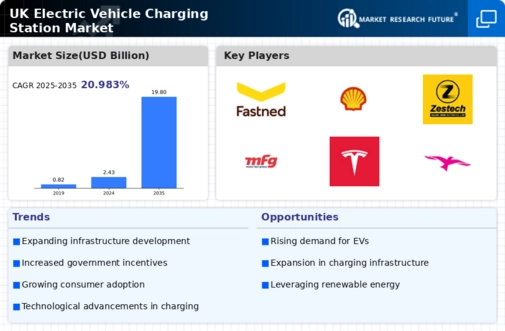

The ongoing trend of urbanization in the UK is a crucial driver for the electric vehicle-charging-station market. As cities expand and populations grow, the demand for efficient transportation solutions increases. Urban areas are witnessing a surge in electric vehicle adoption, which necessitates the development of robust charging infrastructure. Local governments are responding by incorporating charging stations into urban planning initiatives, with many cities aiming to have charging points within a 5-minute walk for residents by 2030. This proactive approach to infrastructure development is likely to enhance the accessibility of charging stations, thereby fostering growth in the electric vehicle-charging-station market. The interplay between urbanization and charging infrastructure is expected to create a more sustainable urban environment.

Rising Consumer Demand for Electric Vehicles

Consumer demand for electric vehicles in the UK is on a notable upward trajectory, which is a critical driver for the electric vehicle-charging-station market. Recent surveys indicate that approximately 40% of new car buyers are considering an electric vehicle as their next purchase. This shift in consumer preferences is largely driven by increasing environmental awareness and the desire for lower running costs. As more consumers opt for electric vehicles, the need for accessible and efficient charging infrastructure becomes paramount. The electric vehicle-charging-station market is responding to this demand by expanding its network of charging points, with projections suggesting a growth of over 30% in the number of charging stations by 2030. This growing consumer base is likely to further stimulate investment in charging solutions.

Technological Innovations in Charging Solutions

Technological innovations are playing a pivotal role in shaping the electric vehicle-charging-station market in the UK. Advancements in charging technology, such as ultra-fast charging and wireless charging solutions, are enhancing the user experience and reducing charging times. As of November 2025, ultra-fast charging stations can deliver up to 350 kW, allowing EVs to charge significantly faster than traditional methods. This rapid evolution in technology is likely to attract more consumers to electric vehicles, thereby increasing the demand for charging infrastructure. Furthermore, the integration of smart technology in charging stations, such as mobile app connectivity and real-time availability updates, is expected to improve the overall efficiency of the electric vehicle-charging-station market.