Government Initiatives and Funding

Government support plays a crucial role in advancing the epigenetics drugs-diagnostic-technologies market. The UK government has been actively promoting research initiatives aimed at understanding the epigenetic basis of diseases. Funding programs and grants are being allocated to support innovative research projects, which in turn fosters collaboration between academic institutions and industry players. For instance, the UK Research and Innovation (UKRI) has committed substantial resources to enhance research capabilities in genomics and epigenetics. Such initiatives not only stimulate scientific discovery but also create a conducive environment for the commercialization of epigenetic technologies, thereby driving market growth.

Rising Awareness of Epigenetic Therapies

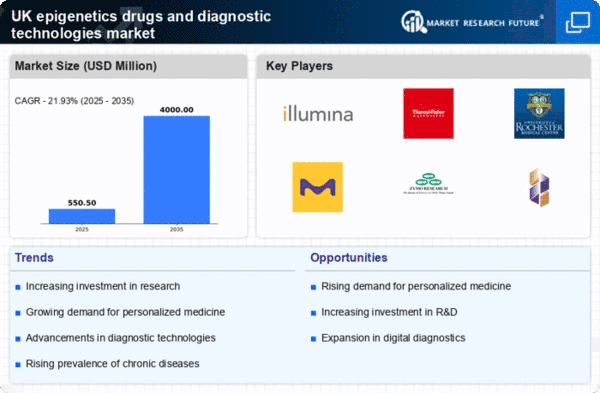

There is a growing awareness among healthcare professionals and patients regarding the potential of epigenetic therapies in treating various diseases. This heightened awareness is contributing to the expansion of the epigenetics drugs-diagnostic-technologies market. Educational campaigns and scientific publications are increasingly highlighting the role of epigenetics in disease prevention and treatment. As a result, healthcare providers are more inclined to explore epigenetic testing and therapies, which could lead to improved patient outcomes. The market is projected to witness a compound annual growth rate (CAGR) of around 15% over the next few years, driven by this increasing recognition of the benefits of epigenetic approaches.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in the UK is a significant driver for the epigenetics drugs-diagnostic-technologies market. Conditions such as cancer, diabetes, and cardiovascular diseases are becoming more prevalent, necessitating innovative treatment approaches. The epigenetics field offers promising avenues for understanding disease mechanisms and developing targeted therapies. According to recent estimates, chronic diseases account for approximately 70% of all deaths in the UK, highlighting the urgent need for effective diagnostic and therapeutic solutions. This growing burden on the healthcare system is likely to propel investments in epigenetic research and the development of novel drugs and diagnostics, thereby expanding the market's scope and potential.

Collaboration Between Academia and Industry

The collaboration between academic institutions and industry stakeholders is fostering innovation in the epigenetics drugs-diagnostic-technologies market. Partnerships are being formed to leverage academic research and translate findings into practical applications. This synergy is crucial for the development of novel epigenetic therapies and diagnostic tools. In the UK, several initiatives are promoting such collaborations, enabling the sharing of knowledge, resources, and expertise. This collaborative environment is likely to accelerate the pace of discovery and commercialization in the epigenetics field, ultimately contributing to the growth of the market. As more breakthroughs emerge from these partnerships, the potential for new products and solutions in the epigenetics market appears promising.

Technological Advancements in Diagnostic Tools

Technological innovations are transforming the landscape of the epigenetics drugs-diagnostic-technologies market. The development of advanced diagnostic tools, such as next-generation sequencing (NGS) and CRISPR-based technologies, is enhancing the ability to analyze epigenetic modifications with greater precision. These advancements enable researchers and clinicians to identify biomarkers associated with various diseases, facilitating early diagnosis and personalized treatment strategies. The UK is witnessing a surge in the adoption of these cutting-edge technologies, which is likely to drive market growth. As the demand for accurate and efficient diagnostic solutions increases, the epigenetics market is expected to benefit significantly from these technological advancements.

Leave a Comment