Rising Incidence of Food Allergies

The increasing prevalence of food allergies in the UK is a significant driver for the food allergy-diagnosis-treatment market. Recent studies indicate that approximately 2-3% of adults and 5-8% of children in the UK are affected by food allergies. This rise in incidence necessitates improved diagnostic methods and treatment options, thereby expanding the market. As awareness grows, healthcare providers are more likely to invest in advanced diagnostic tools and therapies, which could lead to a market growth rate of around 10% annually. The heightened demand for effective management solutions for food allergies is likely to propel innovation and investment in this sector.

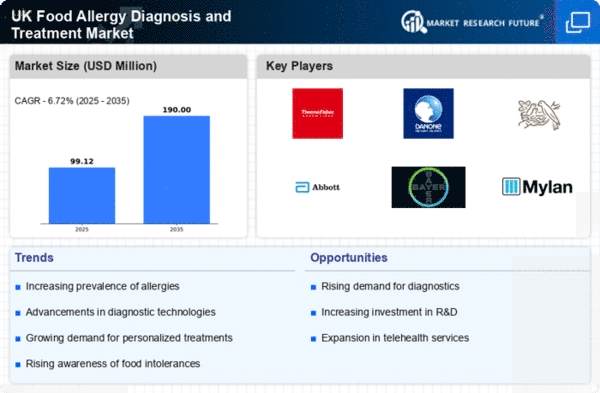

Advancements in Diagnostic Technologies

Technological innovations in diagnostic tools are transforming the food allergy-diagnosis-treatment market. The introduction of specific IgE testing and component-resolved diagnostics has enhanced the accuracy of food allergy identification. These advancements allow for more precise and quicker diagnoses, which are crucial for effective treatment. The market for diagnostic devices is projected to grow significantly, with estimates suggesting a value of over £500 million by 2027. As healthcare providers adopt these technologies, the overall efficiency of allergy management improves, leading to better patient outcomes and increased market demand.

Regulatory Support for Allergy Management

The UK government has been increasingly supportive of initiatives aimed at improving food allergy management. Recent regulatory frameworks have been established to ensure better labeling and safety standards for food products. This regulatory environment is beneficial for the food allergy-diagnosis-treatment market, as it fosters trust among consumers and encourages them to seek necessary medical interventions. The implementation of these regulations is likely to enhance the market landscape, with an anticipated growth in the sector as manufacturers and healthcare providers align with these standards. The market could see an increase in value by approximately £200 million by 2026.

Growing Awareness and Education Initiatives

There is a notable increase in awareness regarding food allergies among the UK population, driven by educational campaigns and advocacy groups. This heightened awareness is crucial for the food allergy-diagnosis-treatment market, as it encourages individuals to seek diagnosis and treatment. Surveys indicate that nearly 70% of the population is now aware of the symptoms and risks associated with food allergies. Consequently, this awareness is likely to lead to a rise in consultations with healthcare professionals, thereby boosting the demand for diagnostic and treatment services. The market is expected to benefit from this trend, with a projected growth rate of 8% over the next few years.

Increased Investment in Research and Development

Investment in research and development (R&D) within the food allergy-diagnosis-treatment market is on the rise, driven by both public and private sectors. This investment is crucial for the development of novel therapies and diagnostic methods. Recent funding initiatives have allocated millions of pounds towards understanding food allergies better and creating innovative treatment options. The R&D sector is expected to grow at a rate of 12% annually, reflecting the urgent need for effective solutions. As new products and technologies emerge, they are likely to reshape the market landscape, providing patients with more effective management options.