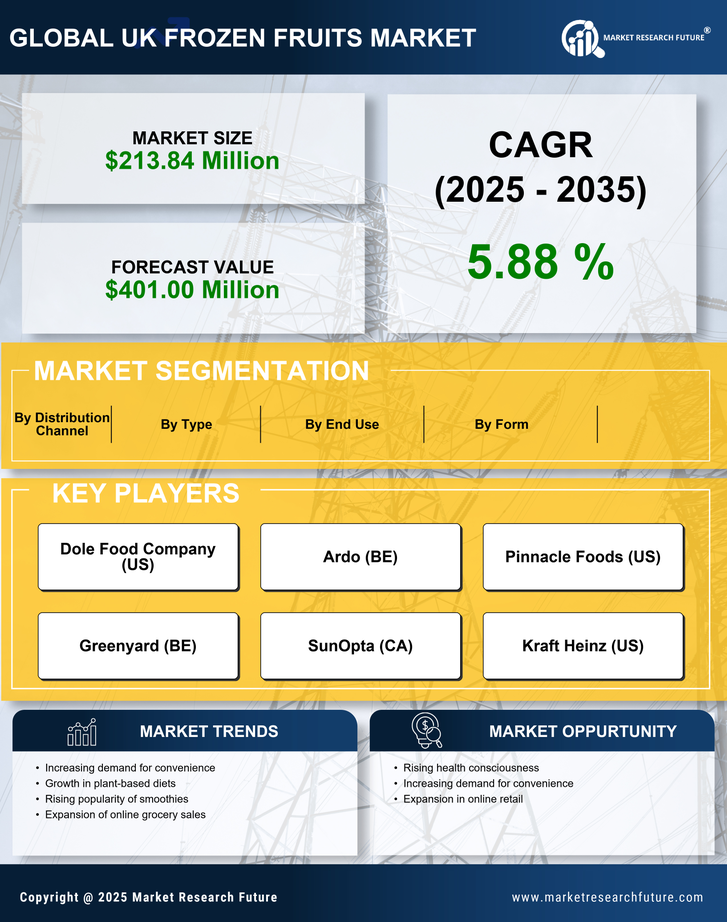

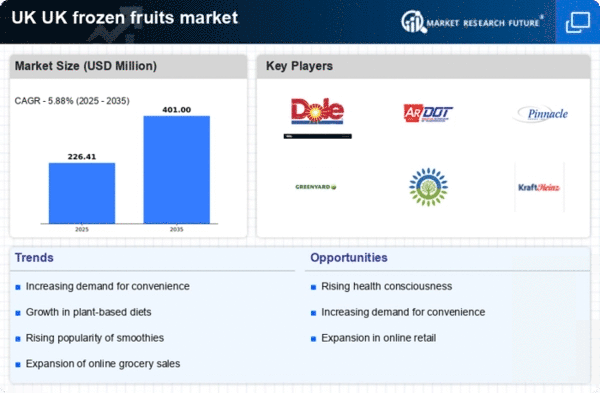

Expansion of Retail Channels

The frozen fruits market in the UK is witnessing an expansion of retail channels, which is significantly impacting accessibility for consumers. Supermarkets, convenience stores, and online platforms are increasingly stocking a diverse range of frozen fruit products. This expansion is crucial, as it allows consumers to easily access frozen fruits, thereby driving sales. Recent data suggests that online grocery shopping has seen a rise of 20% in the last year, with frozen fruits being a popular category. The increased availability of frozen fruits through various retail channels is likely to enhance market penetration and cater to the evolving shopping habits of consumers, further propelling the growth of the frozen fruits market.

Rising Demand for Healthy Snacks

The frozen fruits market in the UK is experiencing a notable increase in demand for healthy snack options. Consumers are increasingly seeking nutritious alternatives to traditional snacks, which has led to a surge in the popularity of frozen fruits. This shift is reflected in market data, indicating that the frozen fruits segment has grown by approximately 15% over the past year. The appeal of frozen fruits lies in their convenience and ability to retain essential nutrients, making them an attractive choice for health-conscious individuals. As the trend towards healthier eating continues, the frozen fruits market is likely to benefit from this growing consumer preference, potentially leading to further innovations in product offerings.

Increased Awareness of Food Waste

The frozen fruits market is also influenced by the increasing awareness of food waste among consumers. As individuals become more conscious of their environmental impact, the ability to purchase frozen fruits allows for better portion control and reduced spoilage. This trend is particularly relevant in the UK, where food waste is a growing concern. Data suggests that approximately 30% of food produced is wasted, prompting consumers to seek solutions that minimize waste. Frozen fruits provide a practical option, as they can be stored for extended periods without losing quality. This awareness is likely to drive more consumers towards the frozen fruits market, as they look for sustainable options that align with their values.

Innovations in Freezing Technology

Advancements in freezing technology are playing a pivotal role in the frozen fruits market. New methods, such as flash freezing, are being adopted to preserve the quality and nutritional value of fruits. This innovation not only enhances the taste and texture of frozen fruits but also extends their shelf life, making them more appealing to consumers. The market is likely to see a rise in products that leverage these technologies, as they can offer superior quality compared to traditional freezing methods. As consumers become more discerning about food quality, the frozen fruits market may experience increased demand for products that utilize cutting-edge freezing techniques, potentially leading to a competitive edge for manufacturers.

Growing Popularity of Smoothie Culture

The frozen fruits market is benefiting from the growing popularity of smoothie culture in the UK. Smoothies have become a staple for many consumers seeking quick and nutritious meal options. The convenience of using frozen fruits in smoothies, which eliminates the need for washing and chopping, is a significant driver of this trend. Market data indicates that smoothie-related products have seen a growth rate of 18% in the past year. This trend is likely to continue, as more consumers incorporate frozen fruits into their daily routines, further solidifying the role of frozen fruits in the health and wellness sector. The frozen fruits market is poised to capitalize on this trend by offering a variety of frozen fruit blends tailored for smoothie enthusiasts.