Growing Focus on Patient-Centric Care

The shift towards patient-centric care is a significant driver in the healthcare business-intelligence market. Healthcare providers are increasingly prioritising patient engagement and satisfaction, which necessitates the use of data analytics to understand patient needs and preferences. By leveraging business intelligence tools, organisations can gain insights into patient demographics, treatment outcomes, and feedback. This information is crucial for tailoring services to meet individual patient requirements. As the healthcare landscape evolves, the emphasis on personalised care is likely to drive further investment in business intelligence solutions. This trend not only enhances patient experiences but also contributes to better health outcomes and operational efficiencies.

Advancements in Technology and Analytics Tools

Technological advancements are significantly influencing the healthcare business-intelligence market. The emergence of sophisticated analytics tools, including artificial intelligence and machine learning, is transforming how healthcare data is processed and analysed. These technologies enable healthcare providers to uncover patterns and trends that were previously difficult to identify. As a result, organisations are increasingly adopting these advanced tools to enhance their analytical capabilities. The integration of AI-driven analytics is expected to improve predictive modelling and patient care strategies. Furthermore, the market is projected to witness a shift towards cloud-based solutions, which offer scalability and flexibility, allowing organisations to adapt to changing needs and demands.

Rising Healthcare Costs and Need for Efficiency

Rising healthcare costs are compelling organisations to seek greater efficiency, thereby driving the healthcare business-intelligence market. With the increasing financial pressures on healthcare systems, there is a pressing need to optimise resource allocation and reduce waste. Business intelligence solutions provide the necessary tools to analyse financial data, operational workflows, and patient care processes. By identifying inefficiencies and areas for cost reduction, organisations can implement strategies that enhance their financial sustainability. The market is likely to see a growing demand for solutions that facilitate cost analysis and performance benchmarking, enabling healthcare providers to make informed decisions that align with their financial goals.

Regulatory Compliance and Reporting Requirements

Regulatory compliance is a critical driver for the healthcare business-intelligence market. In the UK, healthcare organisations must adhere to stringent regulations, including the Data Protection Act and the Health and Social Care Act. These regulations necessitate robust reporting mechanisms and data management practices. As a result, organisations are increasingly investing in business intelligence solutions to ensure compliance and streamline reporting processes. The market is likely to see a rise in demand for tools that facilitate real-time reporting and data governance. This focus on compliance not only mitigates risks but also enhances the overall quality of care provided to patients, as organisations can better track and manage their performance against regulatory standards.

Increasing Demand for Data-Driven Decision Making

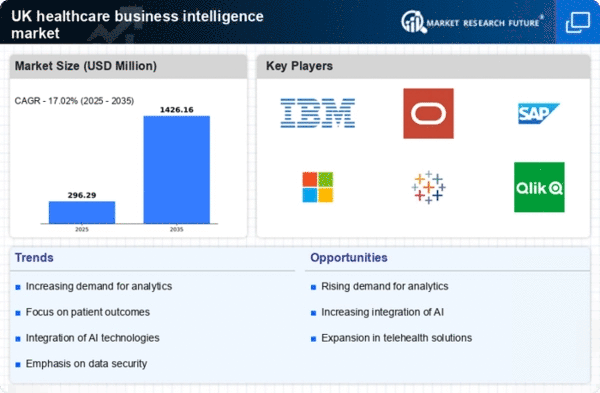

The healthcare business-intelligence market is experiencing a notable surge in demand for data-driven decision making. Healthcare providers are increasingly recognising the value of analytics in improving patient outcomes and operational efficiency. According to recent estimates, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is driven by the need for actionable insights derived from vast amounts of healthcare data. As organisations strive to enhance their service delivery, the integration of business intelligence tools becomes essential. The ability to analyse patient data, operational metrics, and financial performance allows healthcare organisations to make informed decisions, ultimately leading to improved care quality and reduced costs.