Growing Awareness and Education

There is a notable increase in awareness and education surrounding inflammatory bowel disease in the UK, which is driving the inflammatory bowel-disease-treatment market. Campaigns aimed at educating both healthcare professionals and the public about IBD are becoming more prevalent. This heightened awareness leads to earlier diagnosis and treatment, which is crucial for managing the disease effectively. As patients become more informed about their condition, they are more likely to seek treatment options, thereby increasing demand in the market. Additionally, educational initiatives are fostering a better understanding of the importance of adherence to treatment regimens, which can improve patient outcomes and further stimulate market growth.

Increased Healthcare Investment

The UK government and private sector are significantly investing in healthcare, which is positively impacting the inflammatory bowel-disease-treatment market. Increased funding for research and development is fostering innovation in treatment options, leading to the emergence of new therapies. The National Health Service (NHS) has allocated substantial resources to improve patient care for chronic conditions, including IBD. This investment is likely to enhance access to advanced treatments and improve patient outcomes. Furthermore, the focus on healthcare infrastructure development is expected to facilitate better diagnosis and management of IBD, thereby driving market growth. As the healthcare landscape evolves, the inflammatory bowel-disease-treatment market stands to benefit from these financial commitments.

Advancements in Treatment Modalities

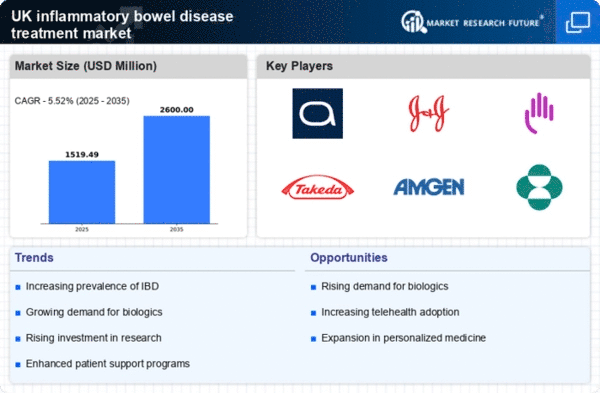

Innovations in treatment modalities are propelling the inflammatory bowel-disease-treatment market forward. The introduction of novel therapies, including biologics and small molecules, has transformed the management of IBD. For instance, the market has seen a surge in the use of monoclonal antibodies, which have demonstrated efficacy in reducing inflammation and achieving remission. The UK market is projected to witness a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by these advancements. Additionally, the development of combination therapies is gaining traction, as they may offer enhanced therapeutic benefits. As new treatment options become available, healthcare providers are better equipped to tailor therapies to individual patient needs, further stimulating market growth.

Regulatory Support for New Therapies

Regulatory bodies in the UK are increasingly supportive of the development and approval of new therapies for inflammatory bowel disease, which is a key driver for the inflammatory bowel-disease-treatment market. The Medicines and Healthcare products Regulatory Agency (MHRA) has streamlined processes for the evaluation of innovative treatments, facilitating quicker access to new therapies for patients. This regulatory environment encourages pharmaceutical companies to invest in research and development, knowing that their products may reach the market more rapidly. As a result, the availability of new and effective treatment options is likely to expand, meeting the needs of the growing patient population and driving market growth.

Rising Incidence of Inflammatory Bowel Disease

The increasing prevalence of inflammatory bowel disease (IBD) in the UK is a primary driver for the inflammatory bowel-disease-treatment market. Recent studies indicate that the incidence of IBD has risen significantly, with estimates suggesting that around 250,000 individuals are currently affected. This growing patient population necessitates the development and availability of effective treatment options. As awareness of IBD increases, more patients seek medical attention, thereby driving demand for innovative therapies. The healthcare system is under pressure to provide adequate treatment solutions, which in turn stimulates market growth. Furthermore, the rising incidence is likely to lead to increased healthcare expenditure, with the inflammatory bowel-disease-treatment market expected to expand as a result.