Regulatory Support and Frameworks

The internet medical-things market benefits from supportive regulatory frameworks established by UK health authorities. The Medicines and Healthcare products Regulatory Agency (MHRA) has been proactive in creating guidelines that facilitate the safe deployment of connected medical devices. This regulatory clarity encourages innovation and investment in the market. As of November 2025, the UK government has allocated £50 million to support research and development in digital health technologies, which is expected to bolster the internet medical-things market. The establishment of clear regulations not only ensures patient safety but also fosters trust among consumers and healthcare providers, thereby driving market growth.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare within the UK, which is significantly impacting the internet medical-things market. As healthcare systems shift from reactive to proactive approaches, the demand for devices that facilitate early detection and continuous monitoring is rising. This trend is reflected in the increasing adoption of wearable health technologies, which allow individuals to track vital signs and health metrics. The internet medical-things market is projected to capture a larger share of the healthcare expenditure, with estimates suggesting that preventive healthcare could account for up to 30% of total healthcare spending in the UK by 2030. This shift not only enhances patient engagement but also reduces long-term healthcare costs.

Consumer Demand for Health Data Accessibility

The internet medical-things market is being propelled by consumer demand for greater accessibility to health data. Patients are increasingly seeking tools that allow them to monitor their health and access their medical information conveniently. This trend is evident in the rising popularity of mobile health applications and connected devices that provide real-time health insights. In the UK, surveys indicate that over 60% of consumers are willing to use digital health solutions to manage their health. This demand is prompting healthcare providers to invest in technologies that enhance patient engagement and data sharing, thereby driving the growth of the internet medical-things market.

Technological Advancements in Medical Devices

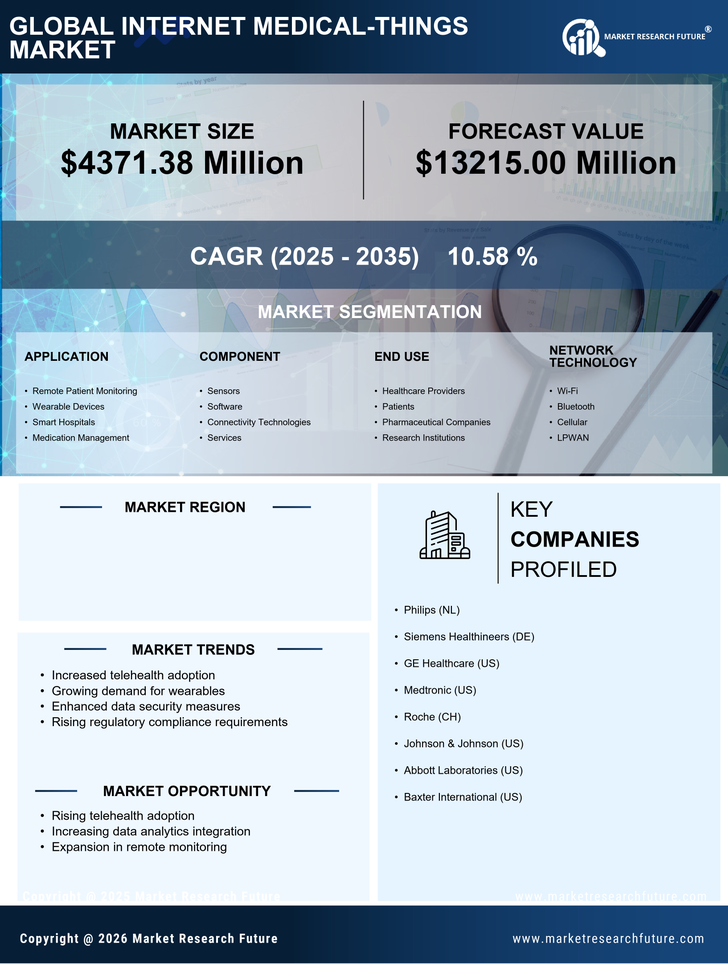

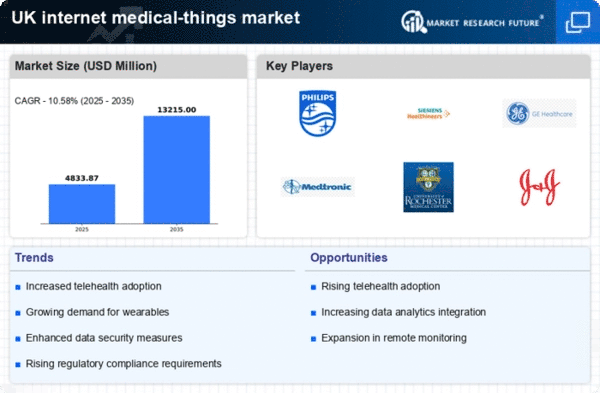

The internet medical-things market is experiencing a surge due to rapid technological advancements in medical devices. Innovations such as IoT-enabled devices and smart sensors are enhancing patient monitoring and data collection. In the UK, the market for connected medical devices is projected to grow at a CAGR of 25% from 2025 to 2030. This growth is driven by the increasing demand for real-time health monitoring and the ability to transmit data securely over the internet. As healthcare providers adopt these technologies, The internet medical-things market is likely to expand. This expansion will offer improved patient outcomes and operational efficiencies.. Furthermore, the integration of artificial intelligence in these devices is expected to enhance diagnostic accuracy, thereby attracting more investments into the sector.

Integration of Artificial Intelligence in Healthcare

The integration of artificial intelligence (AI) into healthcare is emerging as a pivotal driver for the internet medical-things market. AI technologies are being utilized to analyze vast amounts of health data, enabling more accurate diagnostics and personalized treatment plans. In the UK, the application of AI in medical devices is expected to grow significantly, with projections indicating a market value increase of £1 billion by 2027. This integration not only enhances the efficiency of healthcare delivery but also improves patient outcomes. As healthcare providers increasingly adopt AI-driven solutions, the internet medical-things market is likely to witness substantial growth, reflecting the potential of technology to transform healthcare.