Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the internet of-things-in-healthcare market. The UK government has been actively promoting digital health solutions, allocating substantial resources to enhance healthcare infrastructure. For instance, the NHS Long Term Plan emphasizes the integration of digital technologies, including IoT, to improve patient outcomes. With an investment of over £4.5 billion in digital health initiatives, the government aims to foster innovation and support the development of IoT applications in healthcare. This financial backing is likely to accelerate the growth of the internet of-things-in-healthcare market, encouraging startups and established companies to innovate and expand their offerings.

Growing Emphasis on Data Analytics

The internet of-things-in-healthcare market is significantly impacted by the growing emphasis on data analytics. As healthcare organizations increasingly adopt IoT devices, the volume of health data generated is expanding rapidly. In the UK, it is estimated that the healthcare data analytics market will reach £1.5 billion by 2025. This trend highlights the importance of harnessing data to improve clinical decision-making and operational efficiency. By utilizing advanced analytics, healthcare providers can gain insights into patient outcomes and optimize resource allocation. Consequently, the focus on data analytics is likely to drive the growth of the internet of-things-in-healthcare market, as organizations seek to leverage data for better healthcare delivery.

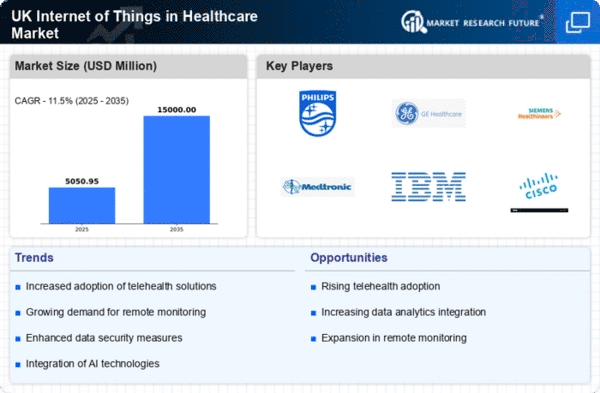

Rising Demand for Telehealth Solutions

The internet of-things-in-healthcare market is experiencing a notable surge in demand for telehealth solutions. This trend is driven by the increasing need for remote consultations and monitoring, particularly among patients with chronic conditions. In the UK, the telehealth market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is largely attributed to the convenience and accessibility that telehealth offers, allowing patients to receive care from the comfort of their homes. As healthcare providers adopt IoT technologies to facilitate telehealth services, the internet of-things-in-healthcare market is likely to expand significantly, enhancing patient engagement and satisfaction while reducing the burden on healthcare facilities.

Increased Focus on Patient-Centric Care

The Internet of Things in Healthcare market is increasingly driven by a focus on patient-centric care. Healthcare providers are recognizing the importance of tailoring services to meet individual patient needs, which is facilitated by IoT technologies. By leveraging data collected from connected devices, providers can offer personalized treatment plans and enhance patient engagement. In the UK, a survey indicated that 70% of patients prefer healthcare services that utilize technology for personalized care. This shift towards patient-centric approaches is likely to propel the internet of-things-in-healthcare market forward, as providers seek to implement IoT solutions that enhance the overall patient experience.

Advancements in Wearable Health Technology

The internet of-things-in-healthcare market is significantly influenced by advancements in wearable health technology. Devices such as smartwatches and fitness trackers are increasingly integrated with IoT capabilities, enabling real-time health monitoring. In the UK, the wearable technology market is expected to reach £2 billion by 2026, reflecting a growing consumer interest in personal health management. These devices not only track vital signs but also provide valuable data to healthcare providers, facilitating proactive care. As the adoption of wearables continues to rise, the internet of-things-in-healthcare market is poised for substantial growth, driven by the demand for continuous health monitoring and data-driven insights.