Rising Cybersecurity Threats

The intrusion detection-system market is experiencing growth due to the increasing frequency and sophistication of cyber threats in the UK. As businesses face a surge in cyberattacks, the demand for robust security solutions has intensified. Reports indicate that cybercrime costs the UK economy approximately £27 billion annually, prompting organizations to invest in advanced intrusion detection systems. These systems are essential for identifying and mitigating potential breaches, thereby safeguarding sensitive data. The urgency to protect digital assets is driving companies to adopt comprehensive security measures, which in turn fuels the expansion of the intrusion detection-system market. As threats evolve, the need for innovative detection technologies becomes paramount, suggesting a sustained upward trajectory for market growth.

Increased Regulatory Requirements

The intrusion detection-system market is being propelled by heightened regulatory requirements in the UK. Organizations are now mandated to comply with stringent data protection laws, such as the General Data Protection Regulation (GDPR) and the Data Protection Act. These regulations necessitate the implementation of robust security measures to protect personal data, thereby increasing the demand for intrusion detection systems. Companies that fail to comply with these regulations face substantial fines, which can reach up to £17 million or 4% of annual global turnover, whichever is higher. Consequently, businesses are investing in advanced intrusion detection solutions to ensure compliance and mitigate risks associated with data breaches. This regulatory landscape is likely to continue driving growth in the intrusion detection-system market.

Growing Awareness of Cybersecurity

The intrusion detection-system market is benefiting from a growing awareness of cybersecurity among businesses and consumers in the UK. As high-profile data breaches and cyber incidents make headlines, organizations are increasingly recognizing the importance of safeguarding their digital infrastructure. This heightened awareness is leading to greater investment in security technologies, including intrusion detection systems. According to recent surveys, approximately 70% of UK businesses consider cybersecurity a top priority, indicating a shift in mindset towards proactive security measures. As awareness continues to rise, the intrusion detection-system market is expected to expand, with more organizations seeking to implement comprehensive security solutions to protect against potential threats.

Expansion of Digital Transformation Initiatives

The intrusion detection-system market is experiencing growth due to the ongoing expansion of digital transformation initiatives across various sectors in the UK. As organizations increasingly adopt digital technologies to enhance operational efficiency, the need for robust cybersecurity measures becomes critical. Digital transformation often involves the migration of sensitive data to cloud environments, which can expose organizations to new vulnerabilities. Consequently, businesses are prioritizing the implementation of intrusion detection systems to monitor and protect their digital assets. The market is projected to witness a surge in demand as more companies embark on their digital transformation journeys, recognizing that effective security solutions are essential for safeguarding their operations in an increasingly digital landscape.

Technological Advancements in Security Solutions

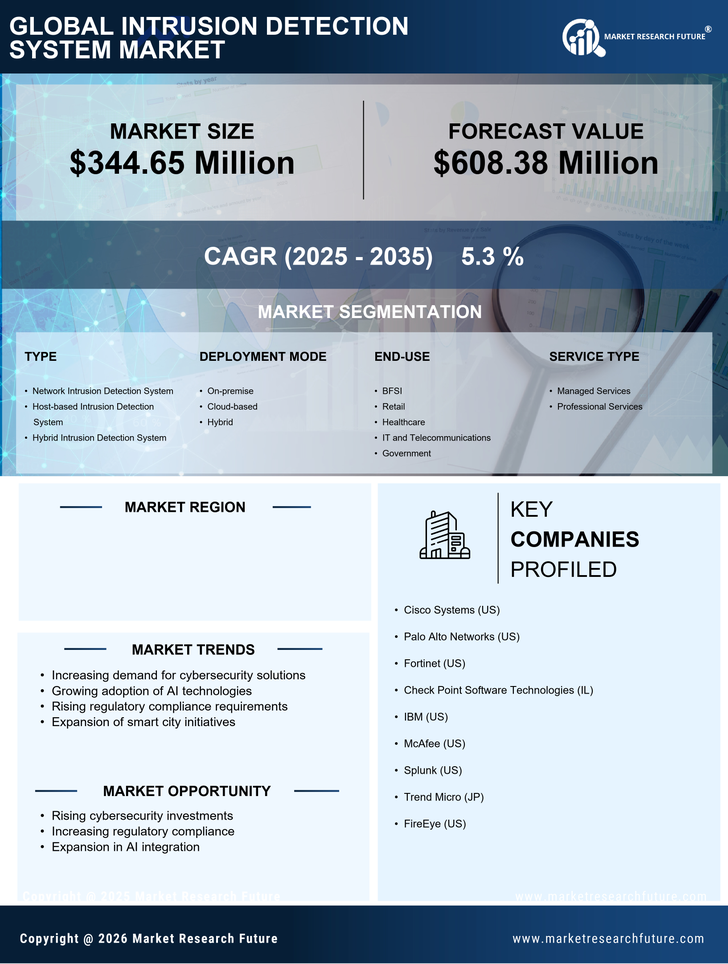

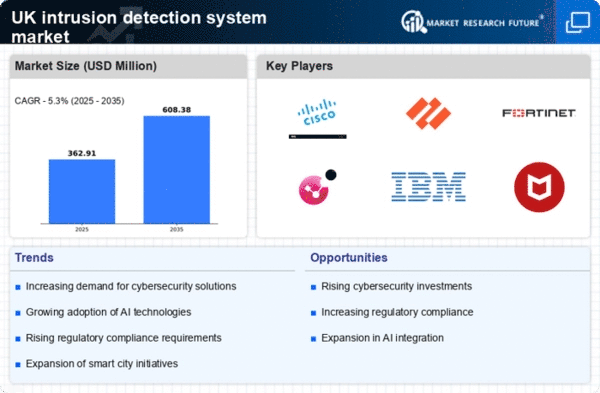

The intrusion detection-system market is significantly influenced by rapid technological advancements in security solutions. Innovations such as real-time monitoring, automated threat detection, and enhanced analytics capabilities are reshaping the landscape of cybersecurity. In the UK, the integration of cutting-edge technologies, including artificial intelligence and machine learning, is becoming increasingly prevalent. These advancements enable organizations to proactively identify vulnerabilities and respond to threats more effectively. The market is projected to grow at a CAGR of 10% over the next five years, driven by the demand for sophisticated security measures. As businesses seek to stay ahead of emerging threats, the adoption of advanced intrusion detection systems is likely to accelerate, further propelling market expansion.