Focus on Enhanced Data Security

Data security is an increasingly pressing concern within the laboratory informatics market, as laboratories handle sensitive information that must be protected from breaches. The rise in cyber threats has prompted laboratories to prioritize the implementation of robust security measures within their informatics systems. In the UK, regulatory bodies are also emphasizing the importance of data security, leading to heightened scrutiny of laboratory practices. As a result, laboratories are investing in informatics solutions that offer advanced security features, such as encryption and access controls. This focus on enhanced data security is likely to drive growth in the laboratory informatics market, as organizations seek to safeguard their data while ensuring compliance with regulatory standards.

Growing Need for Interoperability

Interoperability is becoming a critical driver in the laboratory informatics market, as laboratories increasingly require systems that can communicate seamlessly with one another. The ability to share data across different platforms and devices is essential for enhancing collaboration and improving research outcomes. In the UK, the laboratory informatics market is responding to this need by developing solutions that facilitate interoperability among various laboratory instruments and software. This trend is particularly relevant in multi-disciplinary research environments, where diverse data sources must be integrated for comprehensive analysis. As laboratories strive to enhance their collaborative capabilities, the demand for interoperable informatics solutions is likely to rise, further propelling the growth of the laboratory informatics market.

Emphasis on Automation and Efficiency

The laboratory informatics market is witnessing a significant emphasis on automation and operational efficiency. Laboratories are increasingly adopting automated systems to reduce manual errors and enhance productivity. Automation not only streamlines processes but also allows for real-time data collection and analysis, which is crucial for timely decision-making. In the UK, the laboratory informatics market is expected to benefit from this trend, as organizations seek to optimize their workflows and reduce operational costs. The integration of automated laboratory systems with informatics solutions is likely to enhance data accuracy and reliability, thereby improving overall laboratory performance. This focus on automation is anticipated to drive growth in the laboratory informatics market, as more laboratories recognize the value of investing in technology that supports efficient operations.

Rising Demand for Data Management Solutions

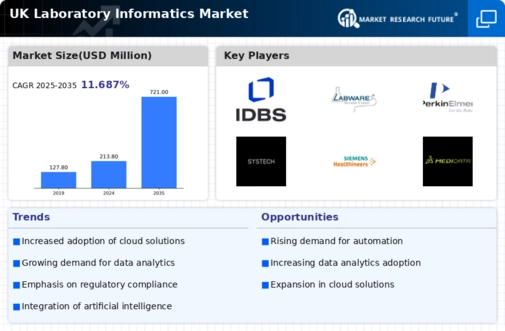

The laboratory informatics market is experiencing a notable surge in demand for advanced data management solutions. This trend is driven by the increasing volume of data generated in laboratories, necessitating efficient storage, retrieval, and analysis. In the UK, the laboratory informatics market is projected to grow at a CAGR of approximately 8% from 2025 to 2030. Laboratories are seeking integrated systems that can streamline workflows and enhance data integrity. As regulatory requirements become more stringent, the need for robust data management solutions is amplified, prompting laboratories to invest in informatics systems that ensure compliance and facilitate data sharing. This rising demand is likely to propel innovation within the laboratory informatics market, as vendors strive to offer solutions that meet the evolving needs of laboratory professionals.

Increased Investment in Research and Development

Investment in research and development (R&D) is a significant driver of growth in the laboratory informatics market. The UK government and private sector organizations are allocating substantial funds to R&D initiatives, particularly in the life sciences and biotechnology sectors. This investment is fostering innovation in laboratory informatics solutions, as companies seek to develop cutting-edge technologies that can support complex research activities. The laboratory informatics market is expected to benefit from this influx of funding, as new solutions emerge that address the specific needs of researchers. Furthermore, as competition intensifies, organizations are likely to prioritize R&D to maintain a competitive edge, thereby stimulating further growth in the laboratory informatics market.

Leave a Comment