Emergence of 5G Technology

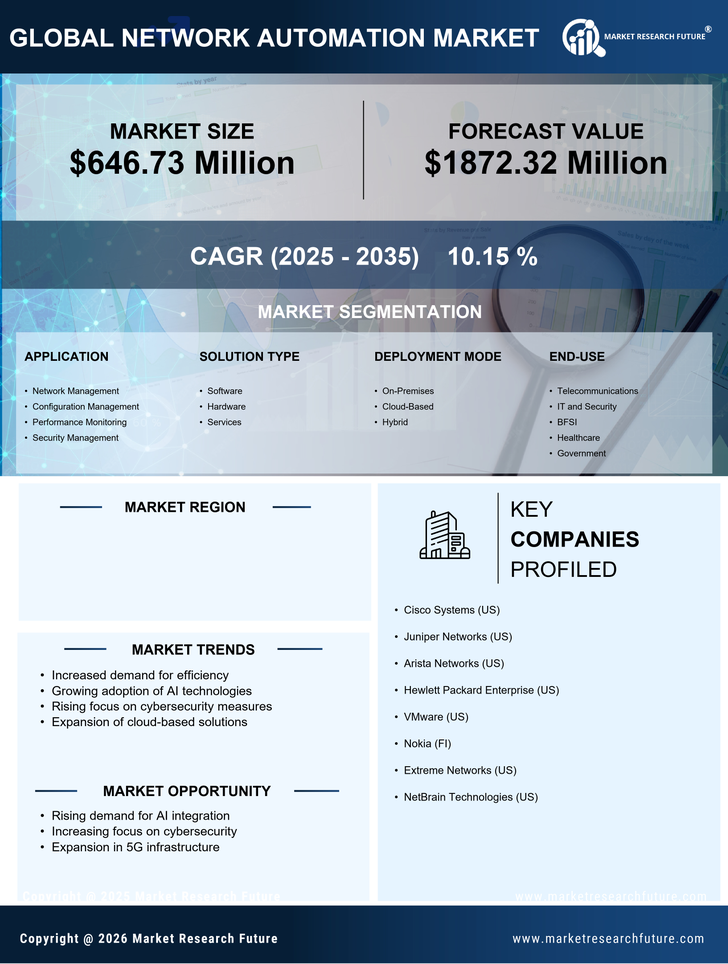

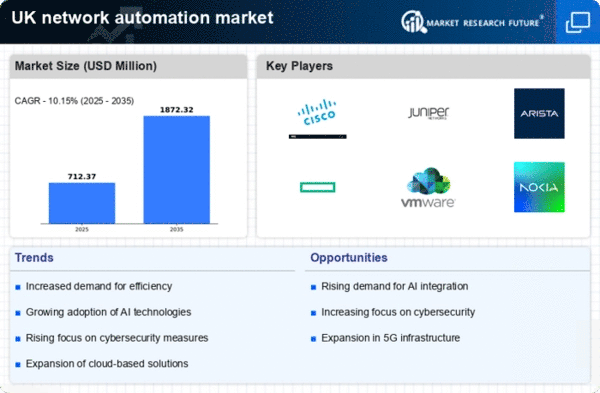

The advent of 5G technology is poised to transform the network automation market in the UK. With its promise of ultra-fast connectivity and low latency, 5G is expected to enable a new wave of automation applications across various industries. The deployment of 5G networks will necessitate advanced automation solutions to manage the increased complexity and scale of network operations. Market Research Future predict that the UK will see a 50% increase in data traffic due to 5G, which will require robust automation tools to ensure optimal performance. This technology is particularly relevant for sectors such as manufacturing and transportation, where real-time data processing is crucial. Consequently, the emergence of 5G technology is likely to drive significant growth in the network automation market as organisations seek to harness its capabilities for enhanced operational efficiency.

Expansion of Cloud Services

The proliferation of cloud services is a critical driver for the network automation market in the UK. As organisations increasingly migrate to cloud-based infrastructures, the complexity of managing these networks escalates. This complexity necessitates the adoption of automation solutions to ensure seamless integration and management of cloud resources. Recent data indicates that the UK cloud services market is projected to grow by 25% annually, further underscoring the need for effective network automation. Automation tools facilitate the management of hybrid and multi-cloud environments, allowing businesses to maintain control over their network configurations and performance. This trend is particularly relevant for sectors such as retail and healthcare, where cloud adoption is rapidly increasing. As a result, the expansion of cloud services is driving the demand for innovative automation solutions within the network automation market.

Growing Focus on Network Security

The network automation market is increasingly driven by the growing focus on network security among UK organisations. As cyber threats become more sophisticated, businesses are recognising the need for automated security solutions to protect their networks. Automation can enhance security by enabling real-time monitoring, threat detection, and response capabilities. Recent surveys indicate that 70% of UK companies consider network security a top priority, leading to a surge in demand for automation tools that can bolster their security posture. This trend is particularly evident in sectors such as finance and critical infrastructure, where the consequences of security breaches can be severe. As a result, the growing focus on network security is propelling the network automation market, as organisations seek to implement comprehensive security measures through automation.

Rising Demand for Operational Efficiency

The network automation market is seeing a surge in demand for operational efficiency among UK enterprises. As businesses strive to streamline their operations, automation technologies are increasingly viewed as essential tools. This trend is evidenced by a reported 30% increase in the adoption of automation solutions across various sectors. Companies are recognising that automating network management can significantly reduce operational costs and enhance service delivery. Furthermore, The integration of automation tools allows for quicker response times to network issues. The drive for efficiency is particularly pronounced in industries such as telecommunications and finance, where the need for reliable and fast network services is paramount. Consequently, this rising demand is propelling growth within the network automation market, as organisations seek to leverage technology to optimise their operations.

Increased Regulatory Compliance Requirements

The network automation market is influenced by the growing regulatory compliance requirements faced by UK businesses. With stringent regulations governing data protection and network security, organisations are compelled to adopt automation solutions to ensure compliance. The implementation of automated systems can help in monitoring network activities, generating compliance reports, and maintaining audit trails, thereby reducing the risk of non-compliance. Recent statistics suggest that 40% of UK companies have faced penalties due to compliance failures, highlighting the urgency for effective solutions. As regulations continue to evolve, the demand for automation tools that can adapt to these changes is likely to increase. This trend is particularly evident in sectors such as finance and healthcare, where compliance is critical. Thus, the increased regulatory compliance requirements are driving growth in the network automation market as businesses seek to mitigate risks associated with non-compliance.