Evolving Data Privacy Regulations

The network forensic market is significantly influenced by evolving data privacy regulations in the UK. The implementation of stringent laws, such as the UK General Data Protection Regulation (GDPR), has heightened the need for organizations to ensure compliance. Companies are increasingly adopting network forensic solutions to monitor data flows and detect potential breaches. In 2025, it is projected that compliance-related expenditures will account for around 30% of the total cybersecurity budget in the UK. This regulatory landscape compels businesses to invest in forensic tools that can provide detailed insights into data handling practices. As regulations continue to evolve, the network forensic market is likely to expand, driven by the necessity for organizations to maintain compliance and protect sensitive information.

Increasing Cybersecurity Investments

The network forensic market in the UK is experiencing a surge in investments as organizations prioritize cybersecurity. With the rise in cyber threats, businesses are allocating more resources to enhance their security infrastructure. In 2025, it is estimated that UK organizations will spend approximately £8 billion on cybersecurity measures, which includes network forensics tools. This trend indicates a growing recognition of the importance of network forensics in identifying and mitigating cyber threats. As companies face sophisticated attacks, the demand for advanced forensic solutions is likely to increase, driving growth in the network forensic market. Furthermore, the need for real-time monitoring and analysis of network traffic is becoming essential, suggesting that investments in this area will continue to rise in the coming years.

Advancements in Forensic Technologies

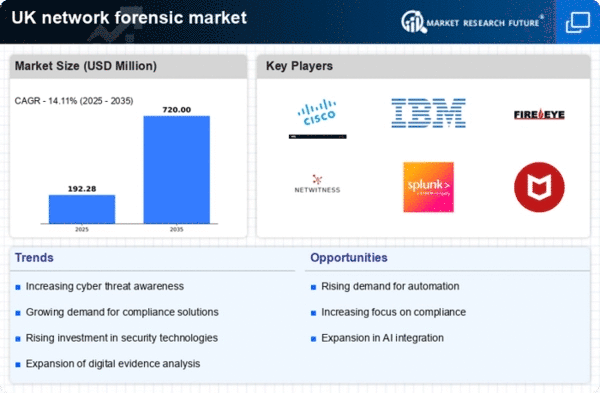

Technological advancements are playing a crucial role in shaping the network forensic market. Innovations in data analysis, machine learning, and artificial intelligence are enhancing the capabilities of forensic tools. In the UK, the adoption of these advanced technologies is expected to increase, with market growth projected at 15% annually through 2025. This growth is indicative of the market's response to the need for more efficient and effective forensic solutions. As organizations face increasingly complex cyber threats, the demand for sophisticated forensic technologies will likely rise. The integration of these advancements into existing forensic frameworks is expected to drive the evolution of the network forensic market, enabling organizations to better detect, analyze, and respond to security incidents.

Rising Awareness of Cybersecurity Risks

There is a notable increase in awareness regarding cybersecurity risks among UK organizations, which is significantly impacting the network forensic market. As businesses recognize the potential consequences of cyber threats, they are more inclined to invest in forensic solutions to safeguard their networks. Surveys indicate that over 70% of UK companies consider network forensics a critical component of their cybersecurity strategy. This heightened awareness is likely to drive market growth, as organizations seek to implement proactive measures to detect and respond to threats. The emphasis on building a robust cybersecurity posture suggests that the network forensic market will continue to expand, with businesses prioritizing investments in tools that enhance their ability to monitor and analyze network activity.

Growing Demand for Incident Response Solutions

The network forensic market is witnessing a growing demand for incident response solutions as organizations seek to enhance their ability to respond to cyber incidents. In the UK, the frequency of data breaches and cyberattacks has prompted businesses to invest in comprehensive incident response strategies. By 2025, it is anticipated that the market for incident response services will reach £1.5 billion, with a significant portion allocated to network forensics. This trend indicates that organizations are recognizing the value of forensic analysis in understanding the nature of attacks and preventing future incidents. The integration of network forensic tools into incident response plans is likely to become a standard practice, further propelling the growth of the network forensic market.