Emphasis on Cost Reduction Strategies

Cost reduction remains a pivotal driver in the operational analytics market. Companies are increasingly leveraging analytics to identify inefficiencies and streamline processes, thereby reducing operational costs. In the UK, businesses are under constant pressure to enhance profitability, and operational analytics provides the tools necessary to achieve this goal. By utilising data-driven insights, organisations can pinpoint areas where expenses can be minimised without compromising quality. Reports indicate that firms employing operational analytics have seen cost reductions of up to 20%, highlighting the potential financial benefits. This focus on cost efficiency is likely to propel further investment in operational analytics solutions, as companies seek to maximise their return on investment.

Rising Demand for Real-Time Data Insights

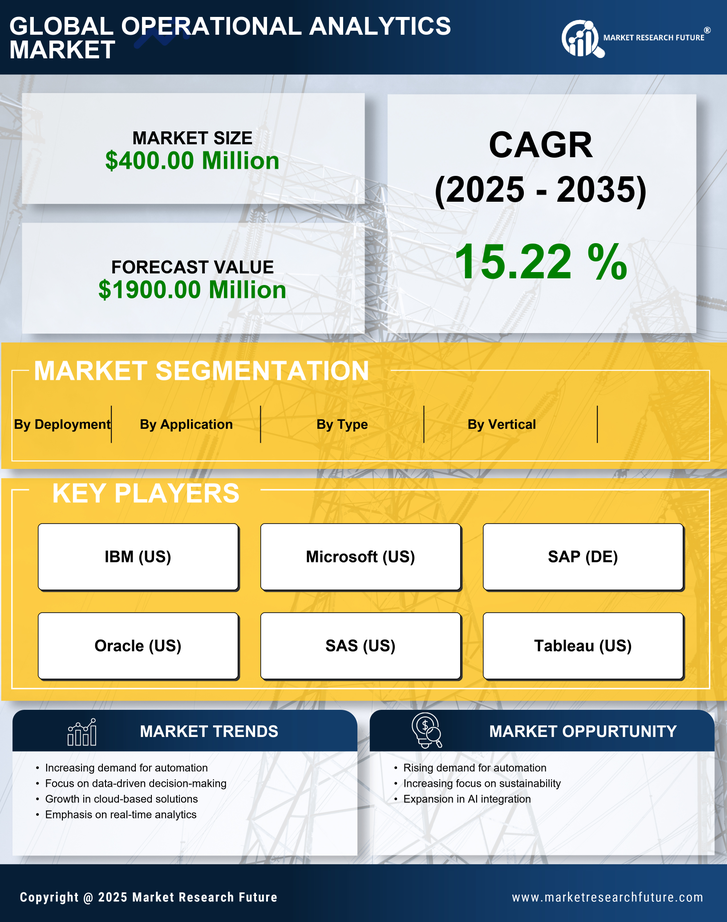

The operational analytics market is seeing a significant increase in demand for real-time data insights.. Businesses across various sectors are increasingly recognising the value of immediate access to operational data, which enables them to make informed decisions swiftly. This trend is particularly pronounced in industries such as retail and manufacturing, where timely insights can lead to enhanced efficiency and reduced operational costs. According to recent estimates, the operational analytics market in the UK is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for organisations to remain competitive in a fast-paced environment. As companies strive to optimise their operations, the ability to analyse data in real-time becomes a critical factor in their success.

Growing Importance of Regulatory Compliance

Regulatory compliance is becoming increasingly critical for businesses operating in the UK, particularly in sectors such as finance and healthcare. The operational analytics market is responding to this need by providing tools that help organisations ensure adherence to various regulations. Companies are utilising analytics to monitor compliance-related data, identify potential risks, and implement corrective actions proactively. The operational analytics market is expected to grow as organizations invest in solutions that help ensure compliance with evolving regulations.. This trend is underscored by the fact that non-compliance can result in substantial financial penalties, making it imperative for businesses to adopt robust analytics frameworks to mitigate risks.

Increased Focus on Customer Experience Enhancement

Enhancing customer experience is a primary objective for many organisations in the UK, and operational analytics plays a crucial role in achieving this goal. By analysing customer data, businesses can gain insights into preferences and behaviours, allowing them to tailor their offerings accordingly. The operational analytics market is responding to this demand by providing solutions that enable organisations to track customer interactions and feedback in real-time. This focus on customer-centric strategies is expected to drive growth in the operational analytics market, as companies strive to improve satisfaction and loyalty. As a result, investments in analytics tools that support customer experience initiatives are likely to increase.

Integration of Advanced Data Visualisation Techniques

The operational analytics market is witnessing a shift towards advanced data visualisation techniques, which enhance the interpretability of complex data sets. As organisations generate vast amounts of data, the ability to present this information in a clear and actionable format becomes essential. Innovative visualisation tools enable stakeholders to grasp insights quickly, facilitating better decision-making processes. In the UK, the demand for such tools is on the rise, as businesses seek to empower their teams with intuitive analytics capabilities. This trend is likely to drive growth in the operational analytics market, as organisations recognise the value of effective data presentation in achieving operational excellence.