Rising Data Traffic

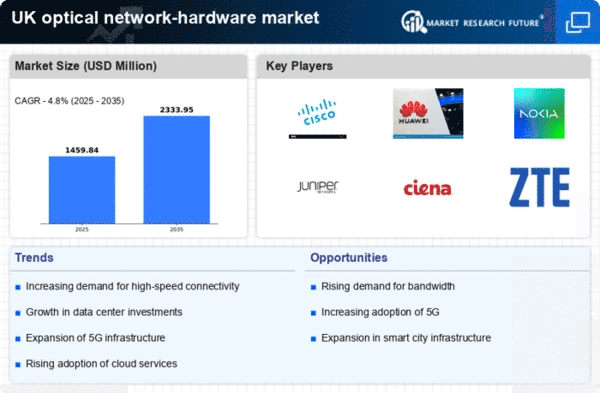

The optical network-hardware market is experiencing a surge in demand due to the exponential increase in data traffic across various sectors. With the proliferation of cloud computing, streaming services, and IoT devices, the need for high-capacity data transmission is paramount. In the UK, data traffic is projected to grow at a CAGR of approximately 25% over the next five years. This growth necessitates the deployment of advanced optical network-hardware solutions to ensure efficient data handling and transmission. As businesses and consumers alike demand faster and more reliable internet services, the optical network-hardware market is poised to benefit significantly from this trend, driving innovation and investment in the sector.

Emergence of 5G Technology

The rollout of 5G technology is poised to have a profound impact on the optical network-hardware market. As 5G networks require extensive fibre optic infrastructure to support their high-speed and low-latency capabilities, the demand for optical network solutions is expected to rise significantly. In the UK, the government and telecom operators are investing heavily in 5G deployment, with projections indicating that 5G subscriptions could reach 30 million by 2025. This rapid expansion necessitates the integration of advanced optical network-hardware to facilitate seamless connectivity and support the increasing number of connected devices. The emergence of 5G technology is likely to drive innovation and growth within the optical network-hardware market.

Government Initiatives and Funding

Government initiatives aimed at enhancing digital infrastructure are playing a crucial role in the optical network-hardware market. The UK government has committed substantial funding to improve broadband access, particularly in rural areas, which is expected to stimulate demand for optical network solutions. Recent reports indicate that the government plans to invest over £5 billion in broadband expansion, which will likely create opportunities for optical network-hardware providers. This funding is intended to facilitate the deployment of fibre-optic networks, thereby enhancing connectivity and supporting the overall growth of the optical network-hardware market. Such initiatives not only improve access but also encourage competition among service providers, further driving market dynamics.

Increased Focus on Network Security

As cyber threats become more sophisticated, the optical network-hardware market is witnessing an increased focus on network security. Businesses and service providers are prioritising the implementation of secure optical networks to protect sensitive data and maintain customer trust. The UK has seen a rise in cyberattacks, prompting organisations to invest in advanced security measures, including encryption and secure access protocols. This trend is likely to drive demand for optical network-hardware that incorporates robust security features. The emphasis on network security not only enhances the reliability of optical networks but also positions the optical network-hardware market as a critical component in safeguarding digital infrastructure.

Shift Towards Fibre Optic Technology

The optical network-hardware market is witnessing a significant shift towards fibre optic technology as businesses and consumers increasingly recognise its advantages over traditional copper-based systems. Fibre optics offer superior bandwidth, lower latency, and enhanced reliability, making them the preferred choice for modern telecommunications. In the UK, the adoption of fibre-to-the-home (FTTH) solutions is gaining momentum, with estimates suggesting that FTTH connections could reach 50% of households by 2026. This transition is likely to drive demand for optical network-hardware, as service providers invest in upgrading their infrastructure to meet consumer expectations for high-speed internet. The ongoing shift towards fibre optics is expected to reshape the competitive landscape of the optical network-hardware market.