Rise of Sports Nutrition

The protein ingredients market is significantly influenced by the rise of sports nutrition, as more individuals engage in fitness and athletic activities. The UK has seen a notable increase in the number of fitness enthusiasts and athletes, leading to a heightened demand for protein supplements and fortified foods. This segment is projected to account for a substantial share of the protein ingredients market, with an estimated growth rate of 8% annually. Athletes and fitness-conscious consumers are increasingly turning to protein powders, bars, and ready-to-drink beverages to support their performance and recovery. Consequently, brands are focusing on developing high-quality protein ingredients that cater to this demographic, further propelling the market's expansion.

Growing Health Consciousness

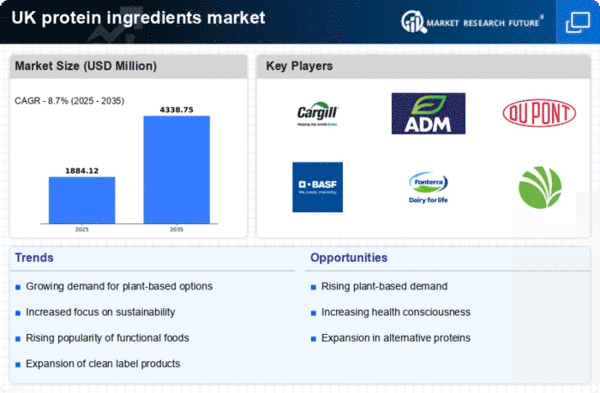

The growing awareness of health among consumers is driving the protein ingredients market. As individuals become more health-conscious, they seek products that contribute to a balanced diet. This trend is reflected in the rising demand for protein-rich foods, perceived as essential for muscle maintenance and overall health. In the UK, the protein ingredients market is projected to grow at a CAGR of approximately 7% from 2025 to 2030. This growth is likely fueled by the popularity of high-protein diets, such as keto and paleo, which emphasize the importance of protein intake. Consequently, manufacturers are innovating to incorporate protein ingredients into various food products, including snacks, beverages, and supplements, to cater to this evolving consumer preference.

Innovation in Food Technology

Innovation in food technology is a key driver of the protein ingredients market, as advancements in processing and formulation techniques enable the development of new protein sources and products. The UK food industry is witnessing a wave of technological innovations, including the use of fermentation and enzymatic processes to enhance protein extraction and functionality. These innovations not only improve the nutritional profile of food products but also address consumer demands for clean label and sustainable ingredients. As a result, the protein ingredients market is likely to benefit from the introduction of novel protein sources, such as insect protein and lab-grown meat, which could reshape consumer perceptions and preferences. This ongoing evolution in food technology is expected to create new opportunities for growth within the protein ingredients market.

Shift Towards Clean Label Products

The protein ingredients market is being propelled by a shift towards clean label products, with consumers preferring transparency in food sourcing and ingredient lists. In the UK, there is a growing demand for products that are free from artificial additives and preservatives, leading manufacturers to reformulate their offerings. This trend is particularly relevant in the protein ingredients market, where consumers seek natural and minimally processed protein sources. According to industry reports, the clean label trend is expected to influence approximately 60% of new product launches in the coming years. As a result, brands are focusing on sourcing high-quality, traceable protein ingredients that align with consumer values, thereby enhancing their market position and driving growth in the protein ingredients market.

Increased Demand for Functional Foods

The protein ingredients market is experiencing a surge in demand for functional foods, which are designed to provide health benefits beyond basic nutrition. Consumers in the UK are increasingly seeking foods that support specific health goals, such as weight management, muscle recovery, and enhanced immunity. This trend is evident in the growing popularity of protein-enriched products, including bars, shakes, and dairy alternatives. According to recent data, the functional food sector is expected to reach a market value of £20 billion by 2026, with protein ingredients playing a crucial role in this expansion. As a result, food manufacturers are investing in research and development to create innovative formulations that meet consumer expectations for both taste and health benefits, thereby driving growth in the protein ingredients market.