Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in the UK is a critical driver of the recombinant proteins market. Conditions such as diabetes, cancer, and autoimmune disorders are on the rise, necessitating effective treatment options. According to recent statistics, chronic diseases account for nearly 70% of all deaths in the UK, highlighting the urgent need for innovative therapies. Recombinant proteins, known for their efficacy and specificity, are becoming essential in the management of these conditions. As healthcare providers seek advanced treatment modalities, the demand for recombinant proteins is expected to grow, thereby positively impacting the market.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is a pivotal driver of the recombinant proteins market. As healthcare becomes increasingly tailored to individual patient needs, the demand for specific therapeutic proteins that cater to unique genetic profiles is likely to rise. In the UK, the market for personalized medicine is projected to grow at a CAGR of 10% over the next five years. This trend is encouraging pharmaceutical companies to invest in the development of recombinant proteins that can be customized for individual patients, thereby enhancing treatment outcomes. The focus on precision medicine may also lead to collaborations between biotech firms and healthcare providers, further stimulating market growth.

Supportive Government Policies and Funding

The UK government is promoting the growth of the recombinant proteins market through supportive policies and funding initiatives. Various programs aimed at fostering innovation in biotechnology are being implemented, which include grants and tax incentives for research and development. The UK government has allocated approximately £1 billion to support life sciences, with a significant portion directed towards recombinant protein research. This financial backing is likely to encourage startups and established companies to explore new avenues in protein development. Additionally, regulatory frameworks are being streamlined to facilitate quicker market access for innovative recombinant therapies, further bolstering the market.

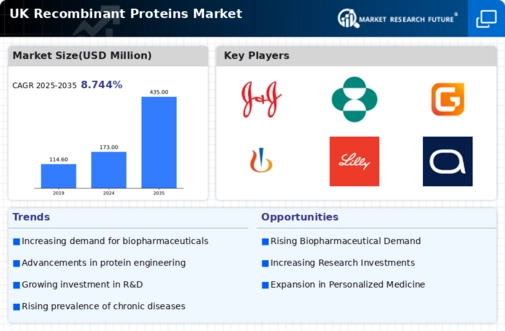

Increasing Investment in Biopharmaceuticals

The recombinant proteins market in the UK is experiencing a surge in investment, particularly in the biopharmaceutical sector. This trend is driven by the growing recognition of the therapeutic potential of recombinant proteins in treating various diseases. In 2025, the UK biopharmaceutical market is projected to reach approximately £25 billion, with recombinant proteins constituting a significant portion of this growth. The influx of funding from both public and private sectors is likely to enhance research and development efforts, leading to the discovery of novel therapeutic proteins. Furthermore, collaborations between academic institutions and industry players are expected to foster innovation, thereby propelling the recombinant proteins market forward.

Technological Advancements in Protein Engineering

Technological innovations in protein engineering are significantly influencing the recombinant proteins market. The advent of sophisticated techniques such as CRISPR and advanced expression systems has enhanced the ability to design and produce recombinant proteins with improved efficacy and safety profiles. These advancements are likely to reduce production costs and time, making recombinant proteins more accessible to healthcare providers. In the UK, the integration of automation and artificial intelligence in production processes is expected to streamline operations, further driving market growth. As these technologies evolve, they may lead to the development of next-generation recombinant proteins, expanding therapeutic applications.