Growing Geriatric Population

The Ultra-High-Definition Endoscopy Market is significantly influenced by the growing geriatric population, which is more susceptible to various health conditions requiring endoscopic evaluation. As the global population ages, the demand for diagnostic and therapeutic endoscopic procedures is expected to rise. This demographic shift is prompting healthcare providers to invest in advanced endoscopic technologies that cater to the needs of older patients. The market is projected to witness a growth rate of approximately 9% annually, driven by the increasing prevalence of age-related diseases such as gastrointestinal disorders. Consequently, ultra-high-definition endoscopy systems are becoming vital tools in managing the health of the elderly, ensuring that they receive timely and effective medical interventions.

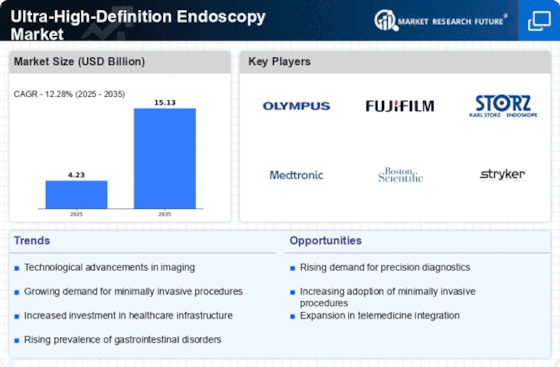

Increased Healthcare Expenditure

The Ultra-High-Definition Endoscopy Market is benefiting from increased healthcare expenditure across various regions. Governments and private sectors are allocating more resources towards advanced medical technologies, recognizing the importance of high-quality diagnostic tools in improving patient care. This trend is particularly evident in emerging economies, where investments in healthcare infrastructure are on the rise. As healthcare budgets expand, the demand for ultra-high-definition endoscopy systems is likely to grow, with market analysts estimating a potential increase of 12% in sales over the next few years. Enhanced funding allows healthcare facilities to upgrade their equipment, thereby improving the overall quality of care and patient outcomes in endoscopic procedures.

Technological Advancements in Imaging

The Ultra-High-Definition Endoscopy Market is experiencing a surge in technological advancements that enhance imaging capabilities. Innovations such as 4K and 8K resolution systems provide unparalleled clarity, allowing for more accurate diagnoses and improved surgical outcomes. These advancements are not merely incremental; they represent a paradigm shift in how endoscopic procedures are performed. The integration of high-definition cameras with advanced light sources significantly improves visualization of anatomical structures. As a result, healthcare providers are increasingly adopting these technologies, leading to a projected market growth rate of approximately 10% annually over the next five years. This trend indicates a robust demand for high-definition endoscopic systems, which are becoming essential tools in modern medical practice.

Integration of Artificial Intelligence

The Ultra-High-Definition Endoscopy Market is increasingly incorporating artificial intelligence (AI) technologies to enhance diagnostic accuracy and procedural efficiency. AI algorithms can analyze endoscopic images in real-time, assisting clinicians in identifying abnormalities that may be missed by the human eye. This integration not only improves patient outcomes but also streamlines workflow in clinical settings. The market for AI-enhanced endoscopic systems is expected to grow substantially, with projections indicating a potential increase of 15% in adoption rates over the next few years. As healthcare systems continue to seek innovative solutions to improve patient care, the role of AI in ultra-high-definition endoscopy is likely to become more pronounced, driving further advancements in the field.

Rising Demand for Minimally Invasive Procedures

The Ultra-High-Definition Endoscopy Market is witnessing a notable increase in the demand for minimally invasive procedures. Patients and healthcare providers alike are gravitating towards techniques that reduce recovery times and minimize surgical trauma. This shift is driven by a growing awareness of the benefits associated with minimally invasive surgeries, including reduced postoperative pain and shorter hospital stays. As a result, the market for ultra-high-definition endoscopy systems is projected to expand significantly, with estimates suggesting a compound annual growth rate of around 8% over the next several years. The ability of ultra-high-definition endoscopy to provide detailed visualization during these procedures is a key factor in its rising adoption, as it enhances the precision and effectiveness of surgical interventions.