Underwater Drone Size

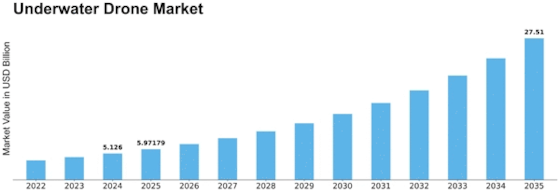

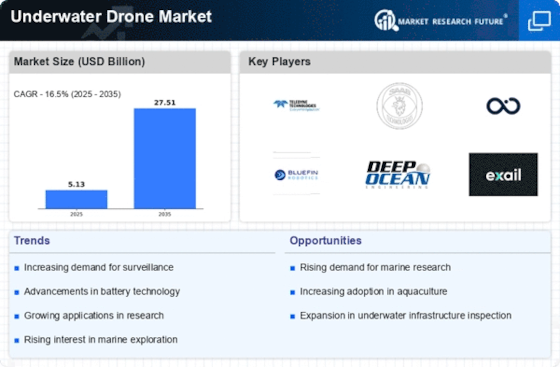

Underwater Drone Market Growth Projections and Opportunities

Remotely Operated Vehicles (ROVs) are like underwater robots that use cables to connect to operators, enabling remote control and navigation. They play crucial roles in various fields such as military and defense, scientific research, and oil and gas operations. Equipped with cameras, high-frequency image sonar, lights, and tools like manipulators and cutting arms, ROVs are driven by operators to explore underwater environments. Despite their demand in the oil and gas industry and maritime security, challenges include high costs, especially compared to divers in shallow waters, and a shortage of trained ROV pilots. However, opportunities arise from the growing need for situational awareness in naval warfare and advancements in 3D printing technology.

The global ROV market is expected to grow at a 10.51% Compound Annual Growth Rate (CAGR) from 2018 to 2023. In 2017, North America led the market with a 30.82% share, followed by Asia-Pacific (27.84%) and Europe (20.38%). Asia-Pacific, particularly in countries like China, India, and South Korea, is emerging as a profitable region for ROV firms due to substantial defense spending.

The global ROV market is categorized based on industry, system component, vehicle type, and region. In terms of industry, the oil and gas segment dominated with a 48.45% market share in 2017, valued at USD 837.0 million. It is projected to grow at a CAGR of 10.05%. In system components, electronics and control systems held the largest market share of 38.46% in 2017, worth USD 664.4 million, with an expected CAGR of 11.02%. Regarding vehicle types, observation vehicles claimed the most significant market share of 46.19% in 2017, valued at USD 798.0 million, and are projected to grow at a CAGR of 10.15%.

ROVs, being versatile underwater tools, play pivotal roles in complex environments. Their applications range from scientific research and oil & gas operations to military and defense purposes. Despite challenges like high costs and a shortage of skilled operators, the global ROV market anticipates robust growth, especially in the Asia-Pacific region, driven by defense spending. With continuous technological advancements and the increasing need for situational awareness, ROVs are set to become even more integral in exploring and securing underwater environments. The market's segmentation highlights the dominance of the oil and gas industry, emphasizing the critical role ROVs play in various sectors.

Leave a Comment