Market Trends

Key Emerging Trends in the Upper GI Series Market

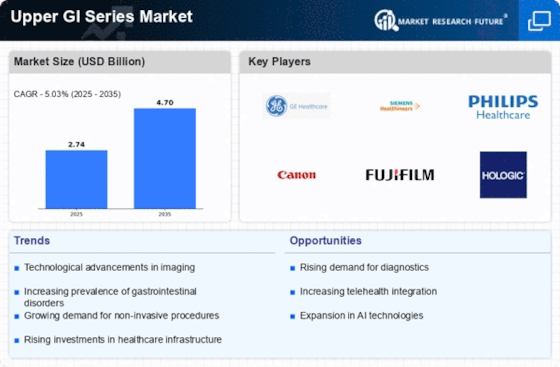

The Upper Gastrointestinal Series, commonly known as an upper GI or barium swallow, is a diagnostic procedure used to examine the upper digestive tract. This market analysis explores key trends in the UGI market, shedding light on the evolving landscape of diagnostic imaging in gastroenterology. The market trend shows a progressive upswing of the set upper gastro.intestinal series processes request. This situation got worse over the years following the rise in cases of aging and issues related to digestive disorders. Furthermore more disease awareness in the gastrointestinal domain has made patients more demanding. In the UGI market, there has been an evident progress in technology which bore-fruits in the invention of digital radiography and fluoroscopy systems. These innovations lead to improved image quality, significantly reducing patients' exposure to radiation, and creating continuous real-time images thereby making more accurate diagnoses possible. Being one of the application areas of artificial intelligence, image analysis aid is another way AI is coming in handy for operators in the market. AI algorithm assists doctors in identification of the negligible abnormalities, diagnosis accuracy, and individuals involved theory. Market tendencies bring to the fore the patient-focused approach of interventions in UGI procedures. Steps are being implemented in order to improve patient comfort, enhance the quality of diagnostic outcomes, reduce procedure times, take into account patient communication needs, etc., that contribute to a better patient experience. There is an observed trend emerging of UGI (Upper GI) procedures being carried out in the ambulatory settings which is a part of another trend in the healthcare field; i.e., it embodies an emerging trend of the healthcare decentralization. Moreover, provisional telemedicine enables doctors to remotely qualify and diagnose UGI images holdings whereas facilitates access and effectiveness in healthcare delivery. Multimodal imaging fusion is increasingly found in UGT market Mixing of UGI test with other imaging techniques, for example, endoscopy or CT scans, allows to visualise the whole gastrointestinal tract and consequently has a great benefit for having a more complete and accurate diagnosis. Market trends underscore the importance of ongoing training for healthcare professionals performing UGI procedures. Continuous skill development ensures that practitioners are proficient in the latest techniques, contributing to the overall quality of diagnostic services. The UGI market is expanding globally, with increased awareness and adoption in emerging economies. Efforts to make diagnostic services more accessible and the transfer of knowledge and technology contribute to the global growth of UGI procedures.

Leave a Comment