Market Analysis

In-depth Analysis of Upper GI Series Market Industry Landscape

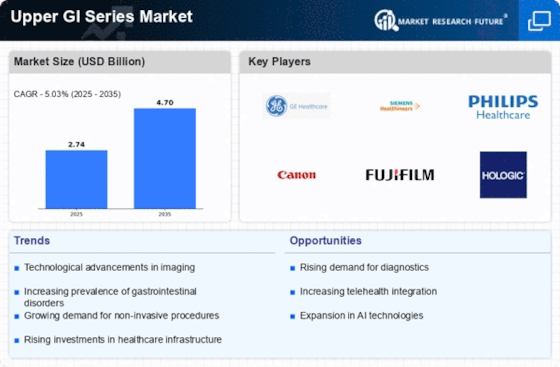

The Upper Gastrointestinal Series, also known as an upper GI or barium swallow, is a medical imaging procedure that examines the upper digestive tract, including the esophagus, stomach, and small intestine. Understanding the market dynamics of this diagnostic tool is crucial for healthcare professionals and stakeholders. The UGI series serves as a vital element of diagnostic imaging tool kits, hence the physicians and other healthcare professionals can assess the condition of structures and functions of upper gastrointestinal organs. This technique is majorly involved in detecting conditions like ulcers, tumors and anomalies that occur in the gut. The niche type of the UGI series is determined by the market indicators such as its size and growth ratios. Since this is one of the most in-demand diagnostic procedure performed regularly, the market experiences a moderate growth; and the trend is also due to the ever-increasing number of people who seek for non-invasive and accurate modes of diagnosing gastrointestinal maladies. The very fact that imaging technology is developed further can serve as the key market competitive driver of the UGI series. These novel innovations lead to a better quality of the images in terms of clarity and precision and they also improve the accuracy of the diagnosis and thus, the patients outcomes are better. The market is determined by UGI series of high reputation as it is considered as the diagnostic and reliability brand. The especialty is applied by healthcare providers that appreciate its ability to identify different gastrointestinal disorders that together with it, make the usage of the modality to be widely distributed. The multi functions of the UGI series on which diagnosing a range of upper gastrointestinal diseases and syndromes like gastroesophageal reflux disease (GERD), hiatal hernias, and swallowing disorders, diversiness market due to that. Its versatile use for this range of GI disorders make it another useful tool for gastroenterologists and other health care providers. The non-invasive property of UGI examination, which is opposed to endoscopy that allows it to see deeper than the competition, also brings to light the market dynamics of this technique. People tend to choose this sort of imaging are due to its comfort mode, which is easy to take, the low possibilities of aftereffects.

Compliance with regulatory standards and quality assurance measures is critical in the UGI series market. Adherence to safety protocols and guidelines ensures patient well-being and maintains the credibility of the diagnostic tool in the healthcare industry. The future outlook of the UGI series market is influenced by ongoing research, technological advancements, and evolving healthcare practices. Continued innovation, integration with artificial intelligence, and the development of more patient-centric approaches are expected to shape the market's trajectory.

Leave a Comment